EXECUTIVE SUMMARY. The integrity of audits in private sector banks and non-bank financial companies (including housing finance) has received a major boost, while large global and domestic audit firms have been dealt a body blow by the Reserve Bank of India’s new guidelines for the

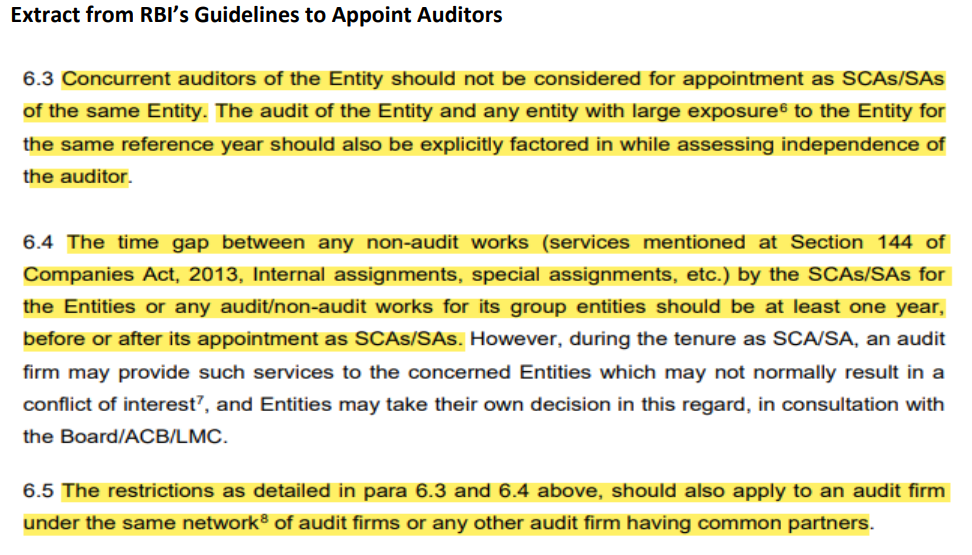

appointment of statutory auditors for the commercial banks and NBFCs. In future the executive and founder-management of private sector financial intermediaries will find it more difficult to exert influence on their statutory auditors.Henceforth, all the audit firm affiliates which were treated as separate entities, but under the same network, will be treated as a single entity. It was common practice for one entity in the audit firm group to be awarded the audit while other entities in the group were given lucrative assignments while simultaneously issuing a “no conflict of interest certificate.” Such an arrangement compromised the entire edifice of audit, and there were no disclosures. The new system entails providing such disclosures to the RBI prior to getting the regulator’s approval.

Source: RBI

Source: RBITill FY2019, global audit firms had a stranglehold on the market of large private sector banks. But their negligent conduct, bordering on complicity, in major corporate frauds in India and abroad has led to a valid rethink regarding their capabilities. Accordingly, the regulator’s guidelines released on April 27, 2021 will curtail their business in the Indian financial sector.

No comments:

Post a Comment