A controversial move

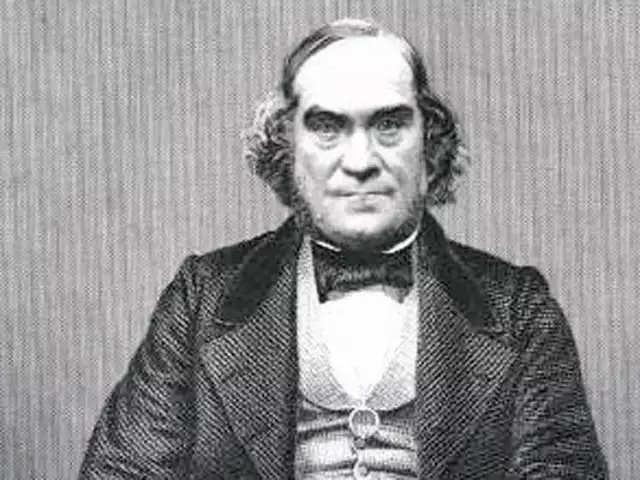

James Wilson, the Scotsman who created India's first Budget, introduced

the income tax act in 1860. This created a big controversy. Wilson

argued since the British provided safe and secure environment

to Indians

to carry on trade they were justified in charging a fee in the form of

an income tax.1/5

Agencies

Solving a crisis

Wilson arrived in India on November 28, 1859, two years after what the

British call the Sepoy Mutiny and Indians their first War of

Independence. The event had drained the resources of the government. The

increased military expenditure had left it with big debts. Wilson, a

self-taught economist with a deep knowledge of how the market worked,

was seen to be the man who could salvage the grave financial situation.

2/5BCCL

Need for tax

Wilson, a liberal and strong proponent of the policy of laissez-faire,

however, failed to see the irony of Britishers first suppressing Indians

and then demanding a tax for providing them a secure atmosphere. His

magazine, The Economist, was sceptical of imperialism. It argued in 1862

that colonies "would be just as valuable to us...if they were

independent”. However, the magazine did believe in the colonial concept

of the white man's burden, saying that "uncivilised races" were owed

"guidance, guardianship and teaching".

3/5Agencies

Government intervention in economy

An article by two Canadian researchers in 2016 analysed the writings on

India of Wilson's magazine from 1843 to the 1860s. It argued that

"despite the adherence of the paper to the ideas of laissez-faire

nineteenth-century liberal ideas of political economy, its writing on

India — and the political career of its founder and editor, James Wilson

— demonstrate a ready embrace of empire, government intervention in the

economy, and increased taxation. The article suggests this difference

can be explained by the expression of colonial difference and attitudes

to race".

4/5Agencies

Valuable financial governance tool

While Wilson's Budget gave India a valuable financial governance tool,

his income tax act upset businesses as well as the landed class, the

zamindars. Aversion to pay income tax, though understandable in colonial

times, has persisted even 70 years after Independence. In December

2016, an income-tax official revealed that India had just 24.4 lakh

taxpayers who declared an annual income of over Rs 10 lakh yet 25 lakh

new cars, including 35,000 luxury cars, were being bought every year for

the last five years.

5/5

No comments:

Post a Comment