The last date for filing GST returns and GST audit report for fiscal year 2017-18 is June 30, 2019.

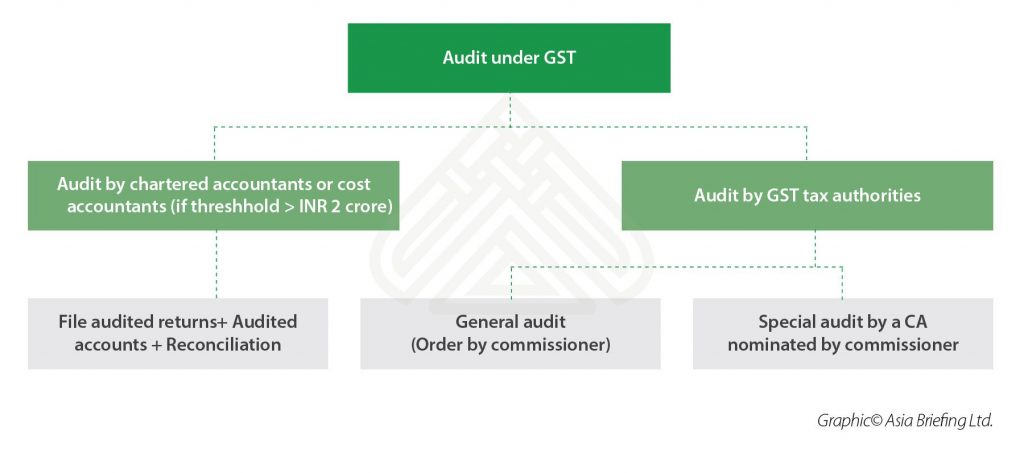

The Goods and Services tax (GST) system requires taxpayers to self-assess their tax liability and pay their tax without any intervention by the tax authorities. The law provides for a robust audit mechanism to measure and ensure compliance by the taxable person.

The GST audit checks the accuracy of information furnished, taxes discharged, refund claimed and input tax credit availed by the individual taxpayer.

For fiscal year 2017-18, India’s GST council in December 2018 extended the last date for filing GST

returns and GST audit report by three months to June 30, 2019.

In this article, we discuss the types of audit available under the GST regime in India and how to manage them.

Audit by chartered accountants or cost accountants

The GST law requires every registered taxable person whose turnover during a financial year exceeds the prescribed limit of INR 2 crore (US $280,131), to get their accounts audited by a chartered accountant or a cost accountant.To file the audit, the taxpayer must submit the following documents electronically:

- an annual return using the form GSTR 9 by December 31 of the next financial year (the government has extended the due date for filling 2017-18 annual returns, and the related audited reports to June 30, 2019) ;

- a copy of audited annual accounts;

- a certified reconciliation statement in the form GSTR-9C, reconciling the value of supplies declared in the return with the audited annual financial statement; and

- any other particulars as prescribed under the law.

Taxpayers must note that the annual return is applicable to all registered persons in GST except input service distributors, casual taxable persons, non-resident taxable persons, and persons liable to deduct tax at source.

For the reconciliation statement, it is advisable for GST registered entities to have a copy and maintain their accounts as a proof to show correctness with regard to the following:

- Production of the goods (Taxable Inward supply of goods and/or service or both Taxable Outward supply of goods and/or services or both);

- Stock of goods;

- Input tax credit availed; and

- Output tax payable and paid.

General GST audit

This is a general audit of the business transaction. Here, the commissioner or any other officer authorized by the commission may undertake the audit of any registered person for such period, at such frequency, and in such manner as prescribed under the GST Law.Audit information and time-frame

The audit may be conducted at the place of business of the registered person or in the office of the commissioner or officer authorized by the commissioner.

The time-frame for carrying out the audit is three months. The officials serve registered taxpayers an advance notice at least 15 days prior to the audit commencement. Starting from this day, the audit must be completed within three months. In special cases, the authorized officer can extend the time-period for audit completion by not more than six months.

During the course of GST audit, the authorized officer may require the registered person to:

- Provide the necessary facility to verify the books of account or other documents as required; and

- Furnish such information as required and render assistance for timely completion of the audit.

Special GST audit

An officer above the rank of assistant commissioner may call for a special GST audit to examine and audit records of a registered taxpayer, including books of account if the regular audit reveals disparities in the taxpayer’s records. These disparities may include:- Incomplete audit;

- Discrepancies observed in the liability with the intention to evade tax; or

- Incorrect revenue declaration.

The officials can order a special audit during any stage of scrutiny, inquiry, investigation or any other proceedings, considering the nature and complexity of the case and in the interest of revenue.

Rectification in return based on GST audit results

If any taxable person, after having furnished a return discovers any omission or incorrect details from the audit results, the taxpayer can rectify the information, subject to payment of interest.However, no rectification is allowed after the tax filing is completed for the month of September, or the second quarter following the end of the financial year, or the actual date of tax filing of the relevant annual return, whichever is earlier.

How to prepare for the GST audit and annual return filing

Companies that have a presence in multiple locations, in the form of a subsidiary or branches across the country, must compute annual turnover on all India PAN basis. The GST Law treats every entity of a company located in more than one state or union territory as distinct.This means that if the company is registered in more than one state or union territory, and the aggregate turnover from all such states exceeds INR 2 crore (US $281,160), then the company must get state-wise accounts audited under the GST law.

Aggregate turnover includes the value of all exempt supplies and exports under the same PAN, on an all India basis. In cases, where companies have multiple GSTIN state-wise registrations on the same PAN, traders and dealers must internally derive their turnover GSTIN-wise and declare the amount in the Form GSTR-9C.

To avoid last minute rush and complexity, it is essential for companies to plan and ensure that the records and documents of each of its subsidiaries and branches are prepared according to the GSTIN number before the filing of annual GST returns. Failing to maintain branch-wise financial statements can make GST auditing a cumbersome process.

Companies that have multiple registrations within the state, too, must maintain separate accounts as the law requires companies to file a reconciliation statement separately for each (GSTIN) registration within the state.

No comments:

Post a Comment