Good and Services Tax (GST), indirect tax in India for the entire nation came into force on 1st July 2017. GST refund is a settlement of any amount that is due to the taxpayers from the administration on export of goods or services, excess reimbursement of taxes or other applicable cases. Complete guide to filing

GSTR-1 and GSTR-3b for exporters of goods and services.

GST refund are an open issue for almost all taxpayers however, it is crucial for exporters. As exporters face a direct impact on their working capital. However, any claim must be filed before 2 years from the date of invoice.

Eligible Scenarios for Claiming GST Refund

Initially, it is important to familiarise themselves with the situations in which GST refund can be demanded. Few of the most common rules and scenarios under GST are stated henceforth:

- When the export transaction has taken place for goods or services, the exporter is eligible for a GST refund.

- Due to an error in calculation, the GST taxpayer paid an additional amount of GST.

- GST paid in case of exempted or nil rated commodity, the deposited money is entitled to be refunded.

- When an exporter is selling at lower tax while paying higher tax rate, then he is fit for GST refund.

- Tax Paid by Embassies or UN Organizations are eligible for GST refund.

- GST refund for international tourists

- Excess tax paid after finalization of provisional assessment of GST.

Non-Eligibility under GST refunds

In case of ineligibility, the refund can be withheld under section 54(3). Few of such circumstances are as follows:

- When invoice is not issued, or application is filled for GST refund after two years of the relevant date.

- If the taxpayer has any form due to the administration, such as tax, interest or penalty.

- In case of inaccurate submission or failing to submit the required documents.

The Relevant Date

Knowledge about the relevant date is particularly vital with respect to reimbursement provisions under GST. It is very important to note The relevant date is different for different situations as mentioned below:

- In export of goods- In case the goods are exported via ship, the relevant date would be invoice date and shipping bill date.

- In instances of deemed exports- The relevant date is the date on which the returns are filed.

- For export of services for GST refund- The relevant date would be the invoice issue date.

- GST refund as a result of judgment- The date of announcement of such a judgment or order.

- GST refund of unutilized ITC- the end of the fiscal year during which claim for refund occurs.In other cases- the date of the tax payed.

- GSTR-1 filed by the 10th of every succeeding month of GST Return.

- GSTR-3B filed by the 20th of every succeeding month of GST Return.

GST refund process for Export of Goods or Services

First step in the GST refund process is filling GSTR-1 online. To claim for GST refund electronic cash register carried out via GSTR-3b through relevant scheduled revenues of a regular and composition dealer respectively. It is necessary for invoice and GST amount in GSTR-1 to match with GSTR3B.

Filing GSTR-1

GSTR-1 filing is the first step to refund. Please make sure to file before 10th of following month of filing return. For example, you are filing return for the month of October 2019 please make sure you file GSTR-1 return by 10th of November 2019. Otherwise late fees and penalties will be applicable and refund process will go through unnecessary delay.

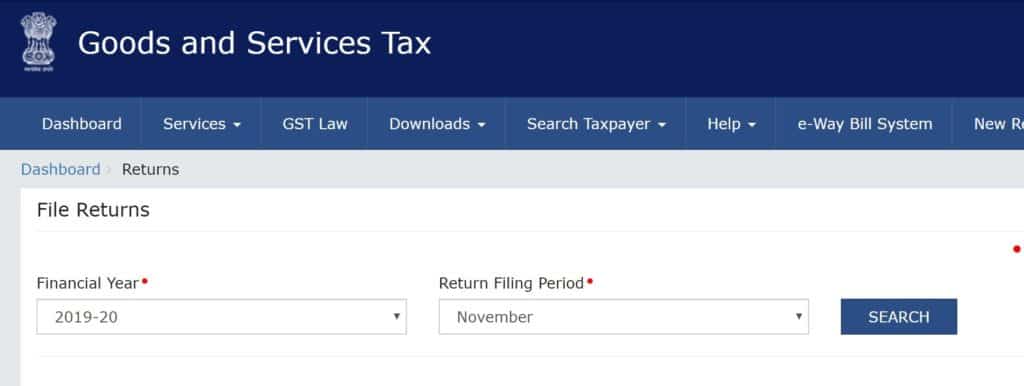

Step 1: Login and Click on Return Dashboard

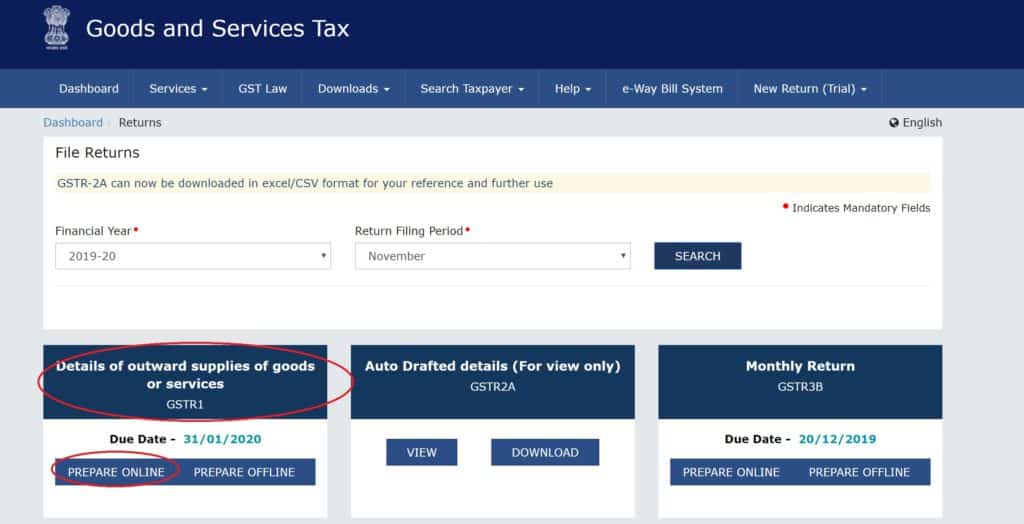

Step 2: Click on GSTR1 Return Prepare online button under details of outward supplies of goods or services

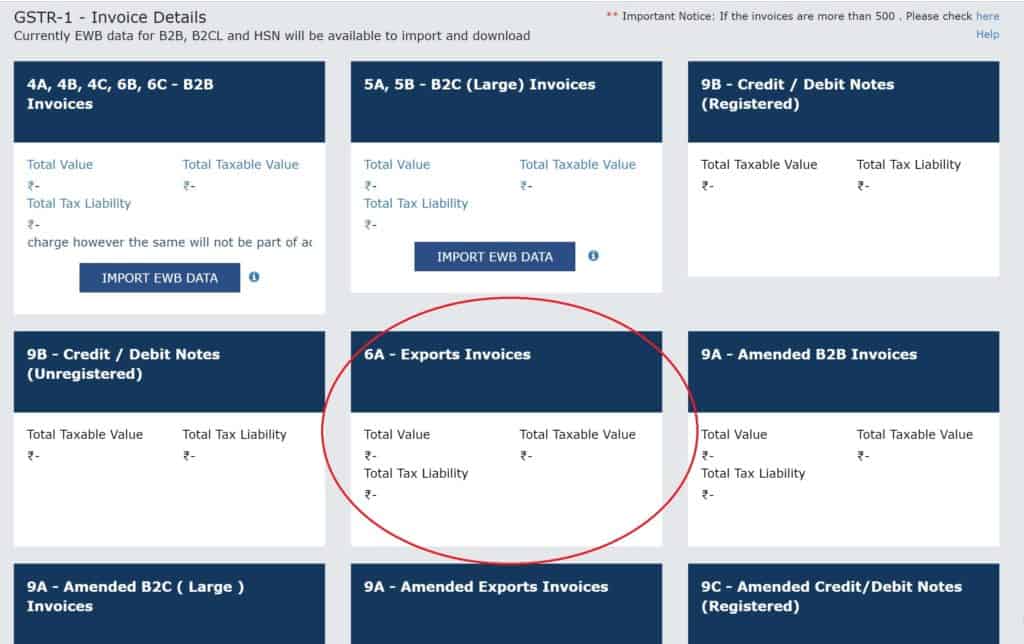

Step 3: Click on 6A- Export Invoices

Step 4: Fill Details of Export Invoices

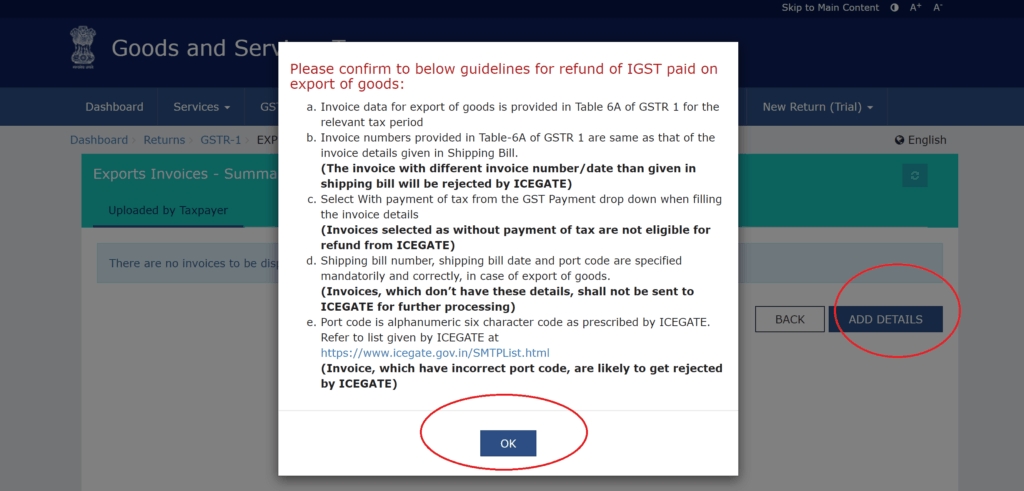

You will see a ICEGATE notification read the same for your information click ok and then click on add details under export invoices summary.

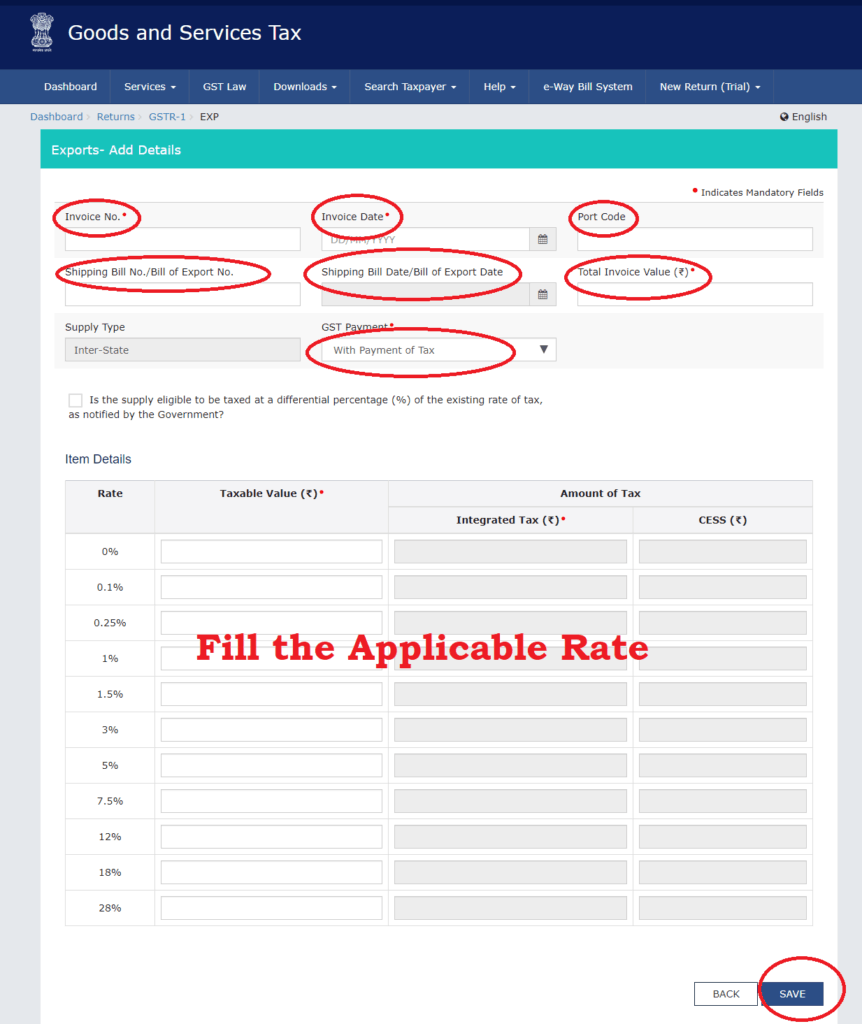

Step 5: Fill the Export Invoice Details

Make sure you correctly mention the details according to shipping bill filed in case of export of goods. In case of export of services you need to fill only invoice no, invoice date, total invoice value, select GST payment with tax and fill the taxable value table.

- Invoice No

- Invoice Date

- Port Code

- Shipping Bill No

- Shipping Bill Date

- Total Invoice Value

- Select GST Payment with Tax

- Fill Table of Taxable Value, Integrated Tax and Cess In case applicablE

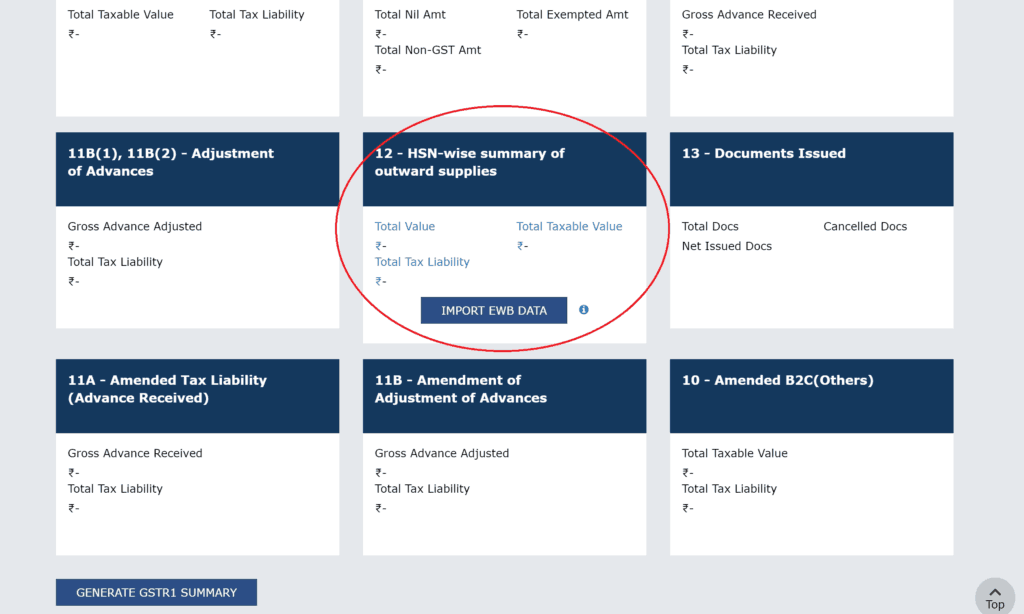

Step 6: Click on HSN-wise summary after saving Export Invoice Details:

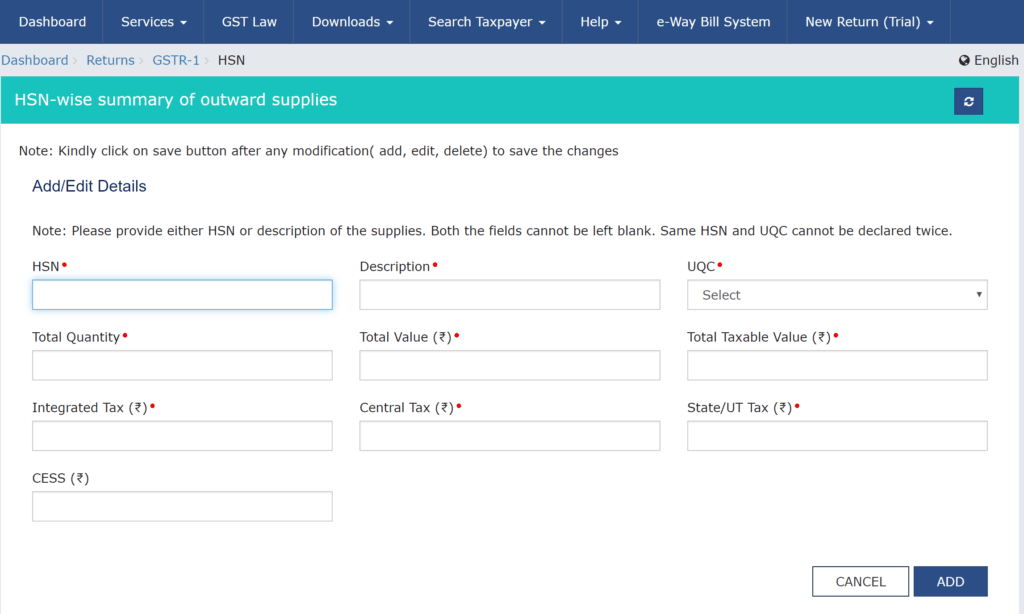

Step 7: Fill all details in HSN-wise summary

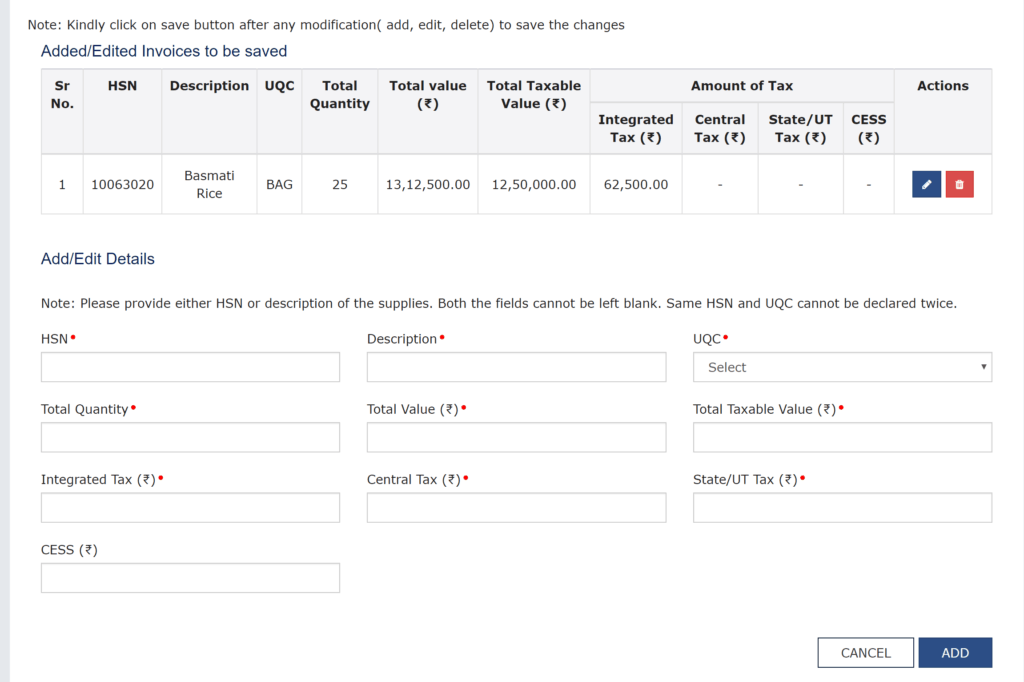

You need to fill all outward supplies of goods or services including domestic sale and export sale. Make sure the values match. For example: you exported Basmati Rice HSN code: 10063020, Description: Basmati Rice Packed in 5Kg Bags Brand, UQC: Metric Tons, Total Quantity: 25, Total Value: INR 1312500, Total Taxable Value: INR 12,50,000 and IGST rate is 5%: INR 62400. Click and and move on to domestic sale incase you have made any and fill details accordingly.

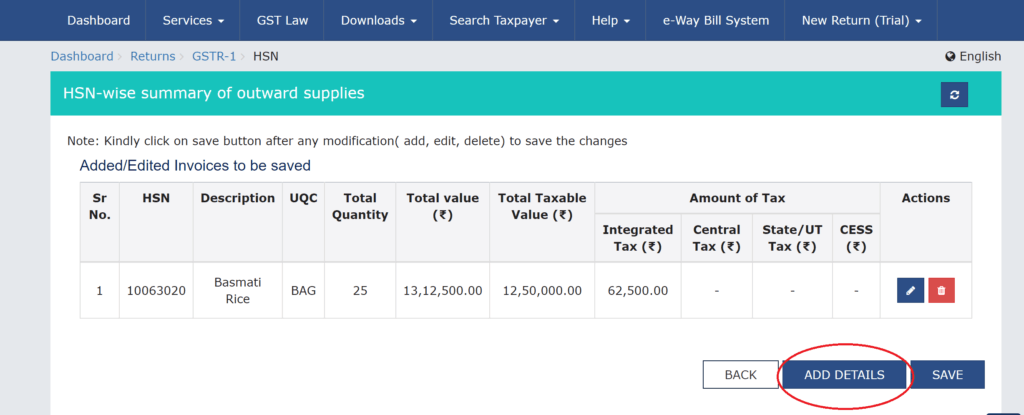

After Adding this you will see this page:

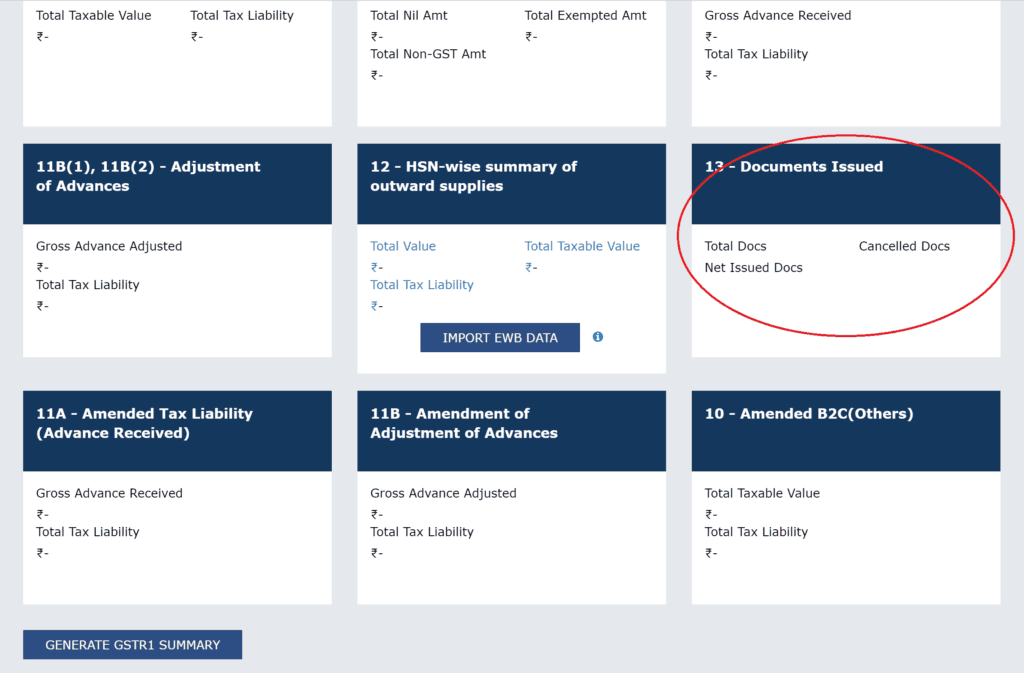

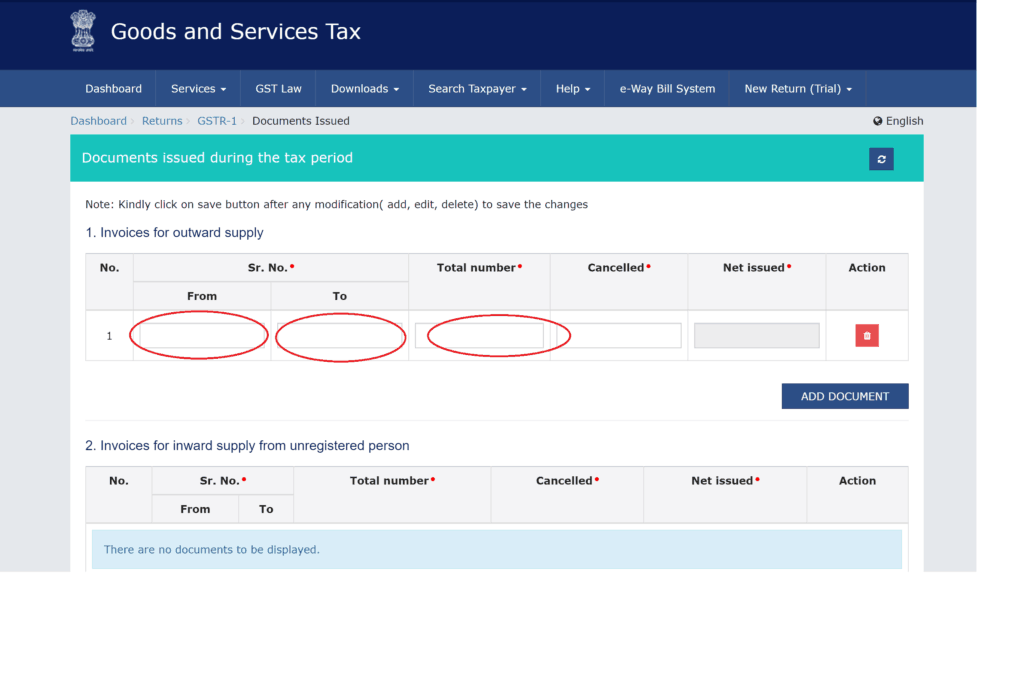

Step 8: Head to 13.Documents Issued and click on the same

Fill the Invoices issued for month of filing return

Click add document scroll down and save button.

Step 9: Submitting and Filing Return

After saving, it will automatically take you to GSTR-1 Dashboard. Click Generate Summary after you have filled all necessary details. Wait for atleast 10 minutes and then tick the acknowledge button and click submit return. Then file the same using your Digital Signature (DSC).

Confirmation Email from GST

Once you have filed GSTR-1 you will receive a confirmation email on your registered email address. Do not worry about the same once you file GSTR-3B the same will be processed without any problem. Email sample:

Dear Sir/Madam,

This is with reference to the recent processing of export invoices for GSTIN ………….. Please be informed that the invoices have failed validation at GST System, and haven’t got transmitted to ICEGATE for further processing.

The GST System uses ledger based approach to validate if sum total of IGST/CESS paid under Table 3.1(b) of GSTR 3B across all periods is equal to, or greater than, the sum total of IGST/CESS from invoices under Tables 6A/9A/6B of GSTR 1 across all periods. The eligible invoices, complete SB/Port details, transmitted by the GST System only if such cumulative validation of IGST/CESS successful.

The GST System does not transmit an eligible invoice to ICEGATE until the aforesaid validation is successful, i.e. the sum paid as IGST/CESS paid under Table 3.1(b) is greater than or equal to IGST/CESS from invoices under Tables 6A/9A/6B. The ledger shows the difference between these two which should be ZERO or positive) for invoices to be transmitted to ICEGATE.

For GSTIN ………………………, the present IGST difference is Rs………………. and the CESS difference is Rs………… You may use table 3.1(b) of subsequent GSTR-3B to fulfil this difference and the GST System shall transmit invoices upon successful validation.

Please feel free to contact GST Taxpayer Helpdesk for any further questions.

Thanks & Regards

Team GSTN

Team GSTN

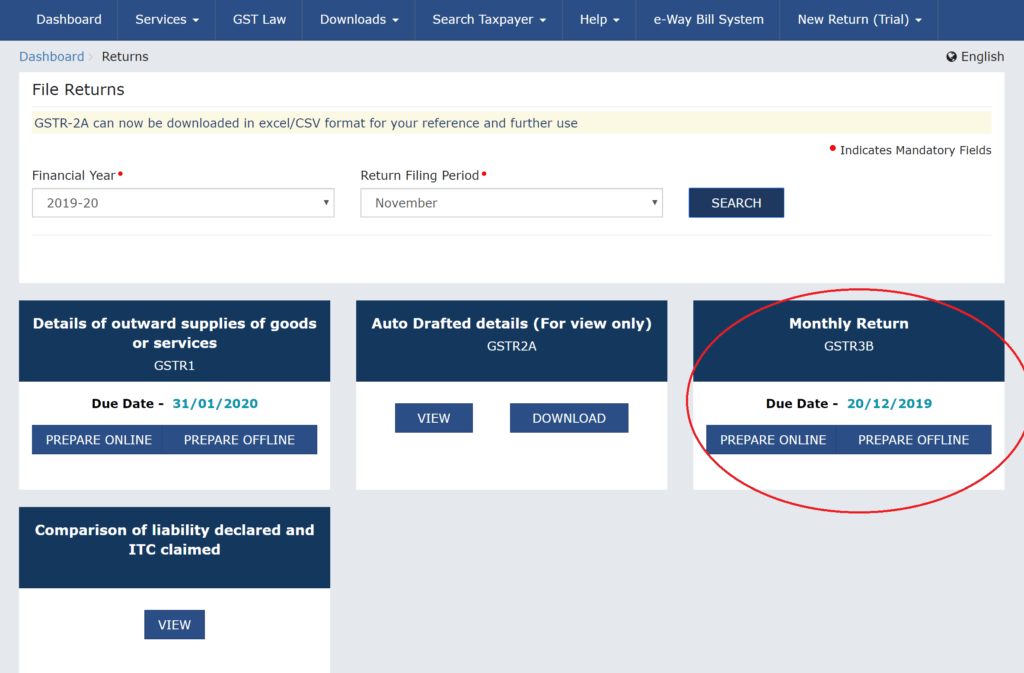

Filing GSTR-3B

Until you file GSTR-3B your refund details cannot be sent to ICEGATE with payment record.

Step 1: Go back to filed return and click on monthly return GSTR-3B Prepare online button.

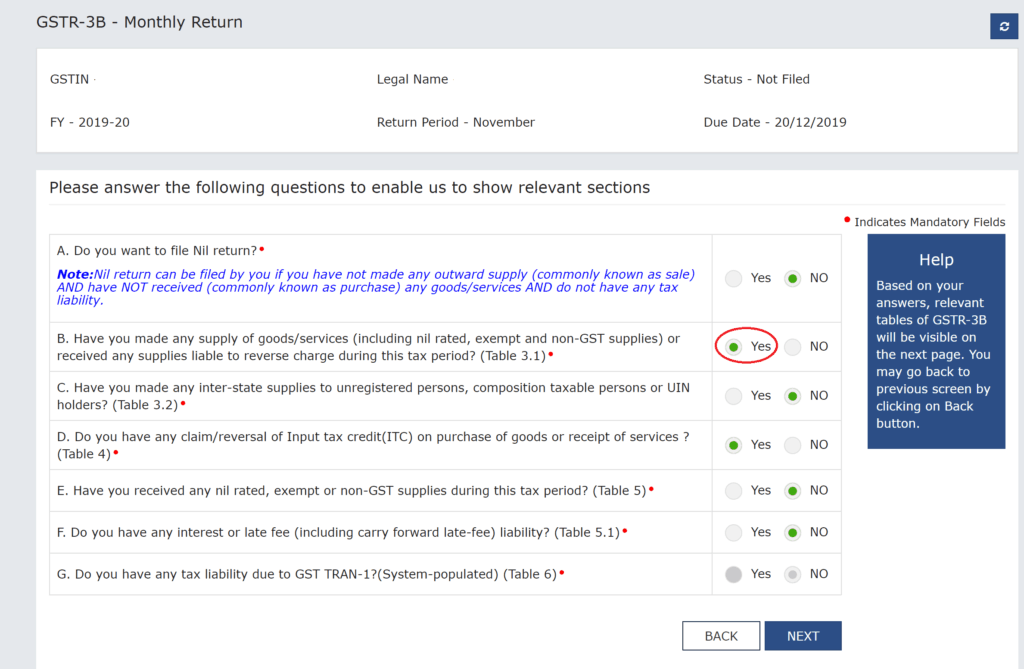

Step 2: GSTR-3B Questions

Fill the questionnaire form. Make sure Point A. (Do you want to file Nil Return?) is marked NO and Point B. (have you made any supply of goods/services or received any supplies liable for reverse charge) marked YES

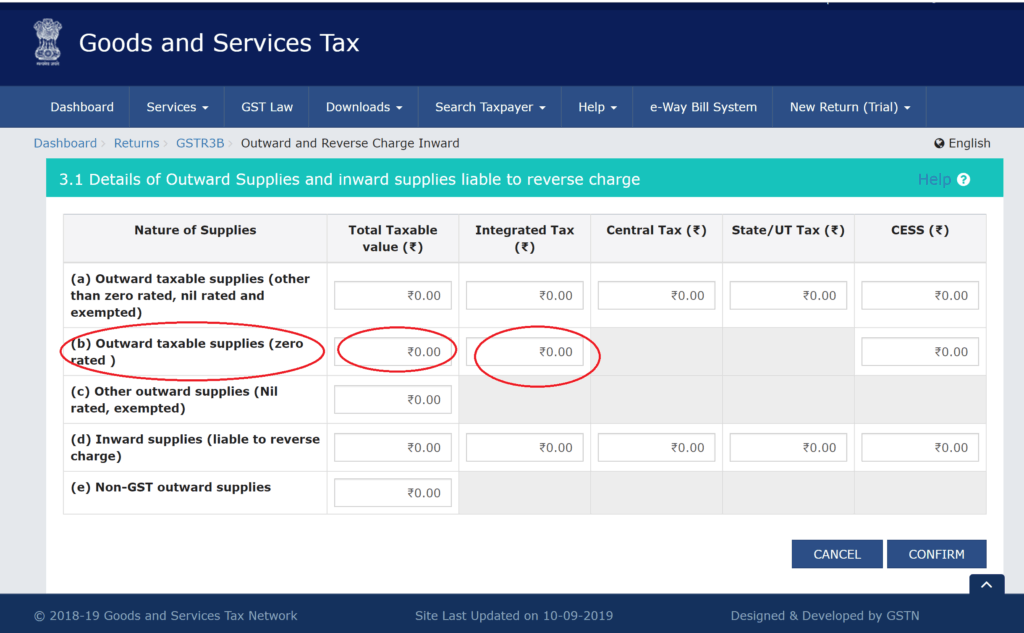

Step 3: Click on Details of Outward supplies and inward supplies liable for reverse charge

Column b is most important for GST refund process for exporters. Make sure you fill the exact same amount as you have filled in GSTR-1. IGST amount and Taxable value should match the shipping bill/export invoice and GSTR-1. Otherwise, refund will get stuck and a longer process will follow for availing the same.

Fill rest of the details as per taxable or non taxable supplies received during the month.

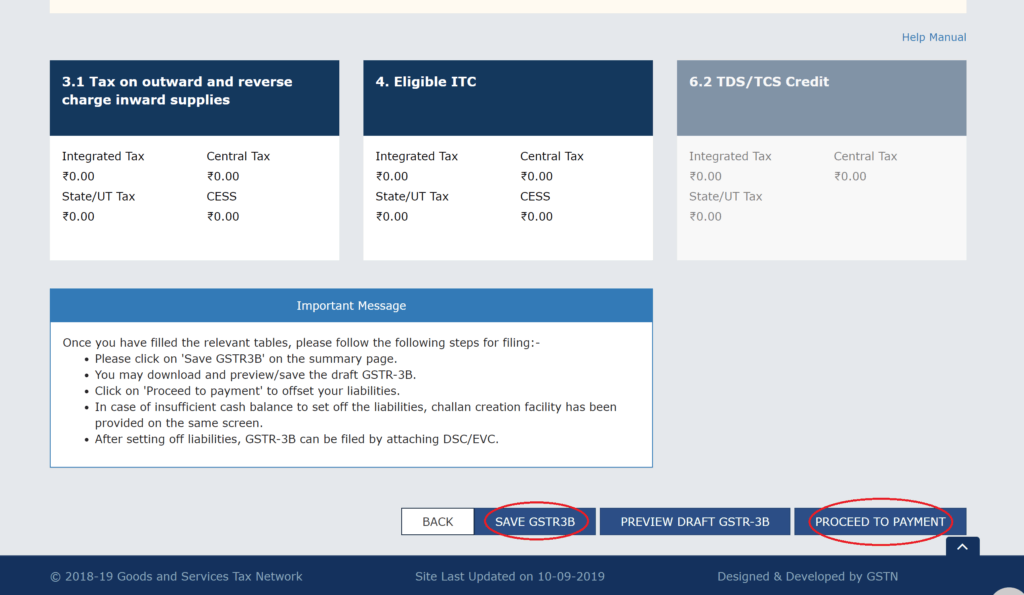

Step 4: File GSTR-3B

Final step is filing GSTR-3B. Click Save GSTR-3B and wait for 10 min before the same is updated online. Then head to proceed to payment. Your Input tax will be adjusted incase you do have any ITC otherwise you need to make the payment. Once payment is made file GSTR-3B using Digital signature.

Email Confirmation GST ICEGATE Transmission

After filing GSTR-3B you will receive an email confirmation on your registered email address:

Dear Sir/Madam,

Please be informed that 1 invoice(s) with IGST amount of Rs…………. and CESS amount of Rs………. transmitted to ICEGATE for GSTIN…………………………

The GST System provides a facility to check return period wise status of transmission of invoice data, and view transactional level details used to maintain export ledger. The same can be accessed by taxpayer by navigating to Services – Refund – Track status of invoice data to be shared with ICEGATE, after logging into the GST Common Portal.

You may also login to IEC Holder Portal to get ICEGATE level validation status of transmitted invoices.

Please feel free to contact the GST Taxpayer Helpdesk for any further questions.

Thanks & Regards

Team GSTN

Team GSTN

No comments:

Post a Comment