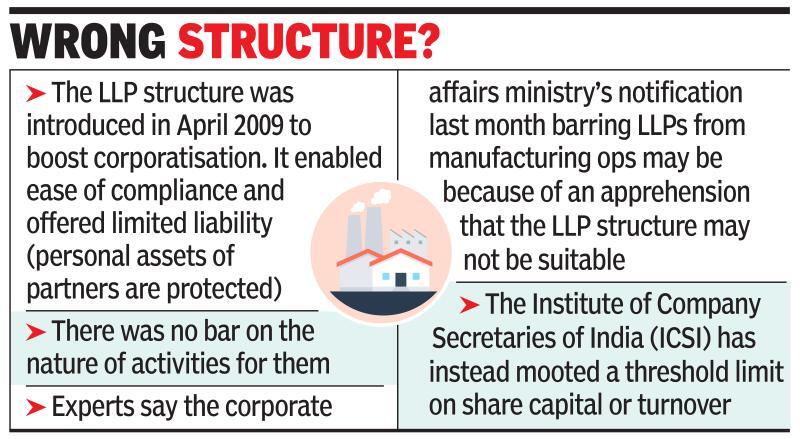

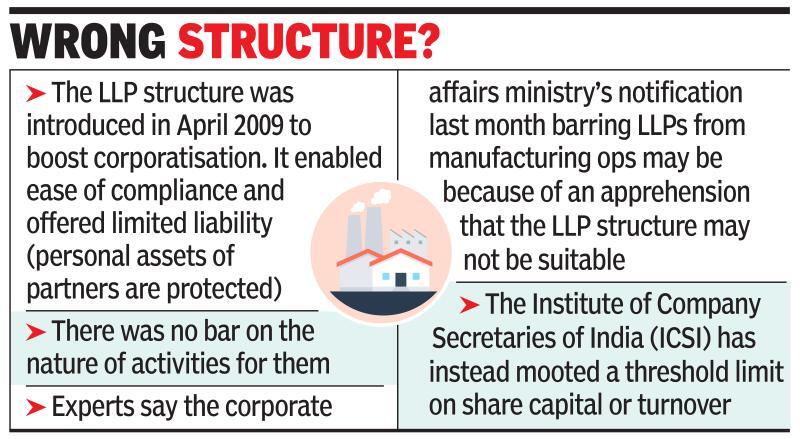

The ministry of corporate affairs (MCA)

has barred entities carrying on manufacturing activities from adopting

the limited liability partnership (LLP) structure. Nor can a private

company involved in manufacturing be converted into an LLP. Further, the fate of more than 10,000 existing LLPs engaged in manufacturing hangs in the balance.

Recently, a family owned entity carrying on small-scale business operations in an industrial area of

Bengaluru found they could not convert their private company into an LLP structure. The main reason for their wishing to opt for the LLP structure was relatively simpler regulatory requirements. Or for that matter, an entrepreneur engaged in manufacture of leather dyes in Mumbai wanted to incorporate as an LLP. But based on the recent stand by the corporate affairs ministry, he has been advised to incorporate as a company.

The term ‘business’ as defined under section 2(1)(e) of the LLP Act includes trade, profession, service and occupation. “Manufacturing and allied activities have been positively excluded from this definition,” states a March 6 notification, issued by the central registration centre (CRC), MCA. It is this centre that incorporates LLPs. The notification refers to the minutes of an internal review workshop conducted in December, where it was concluded that the object of an LLP is mainly for carrying out professional services and not manufacturing activities.

In the past, manufacturing entities were allowed to set shop as LLPs. According to latest available official statistics as of December 2017, there were 12,770 active LLPs engaged in manufacturing — this is around 12% of total active LLPs as of this date. Surprisingly, the MCA notification is silent on their fate, which is leaving practising company secretaries perplexed. Till the time of going to the press, MCA did not respond to an email sent by TOI in this regard.

“Although the definition is inclusive in nature and is not expected to be read in order to limit the coverage only to the activities in the services sector, there appears to be a view at the CRC/MCA level that LLPs cannot be engaged in manufacturing and/or allied activities,” states PwC India partner (regulatory services) Anshul Jain. “One may note that the Indian Partnership Act also defines a business in the same manner. This makes the stand taken as regards LLP a bit odd,” he adds.

“My view is, if the regulator has registered LLP in the past and allowed partnership firms to do manufacturing activity, then there is no harm in an LLP continuing to do the manufacturing business. There is too much of intrusion by introducing ad hoc notifications. It should be left to the entrepreneurs to decide on the type of entity to do business,” states Bengaluru-based practising company secretary J Sundharesan.

“The restriction on including manufacturing activities for LLP may be due to an apprehension that, for entities with massive manufacturing operations having factories and heavy investments in machinery, the LLP structure may not be suitable. However, if that was the case, this should have been restricted at the very first stage,” states Gopika Shah, partner at GHV & Co, a firm of practising company secretaries.

The Institute of Company Secretaries of India (ICSI) has represented to the MCA that the objective does not seem to restrict manufacturing entities as LLPs, nor are any such restrictions placed in countries like Singapore and the UK. “In case there is an apprehension that manufacturing business incorporated as LLPs would become very large and not suitable as an LLP entity, a threshold limit on share capital or turnover may be considered,” it suggests.

Explaining the possible intent of the notification, Jain states, “There are certain disclosures required under the Companies Act, such as filing of key resolutions of board meetings or special resolutions of shareholders meetings, which doesn’t apply in case of LLPs. Concerns in this regard could have led to this stand taken by the MCA.”

Till date, professionals say that no notices have been received by existing LLPs engaged in manufacturing. “However, there are only two options available to them. They can either close down the LLP and do business in the form of an unincorporated entity like a proprietary or partnership format, or convert the LLP into a company, which may be troublesome for small- and mid-level LLPs,” explains Shah.

Recently, a family owned entity carrying on small-scale business operations in an industrial area of

Bengaluru found they could not convert their private company into an LLP structure. The main reason for their wishing to opt for the LLP structure was relatively simpler regulatory requirements. Or for that matter, an entrepreneur engaged in manufacture of leather dyes in Mumbai wanted to incorporate as an LLP. But based on the recent stand by the corporate affairs ministry, he has been advised to incorporate as a company.

The term ‘business’ as defined under section 2(1)(e) of the LLP Act includes trade, profession, service and occupation. “Manufacturing and allied activities have been positively excluded from this definition,” states a March 6 notification, issued by the central registration centre (CRC), MCA. It is this centre that incorporates LLPs. The notification refers to the minutes of an internal review workshop conducted in December, where it was concluded that the object of an LLP is mainly for carrying out professional services and not manufacturing activities.

In the past, manufacturing entities were allowed to set shop as LLPs. According to latest available official statistics as of December 2017, there were 12,770 active LLPs engaged in manufacturing — this is around 12% of total active LLPs as of this date. Surprisingly, the MCA notification is silent on their fate, which is leaving practising company secretaries perplexed. Till the time of going to the press, MCA did not respond to an email sent by TOI in this regard.

“Although the definition is inclusive in nature and is not expected to be read in order to limit the coverage only to the activities in the services sector, there appears to be a view at the CRC/MCA level that LLPs cannot be engaged in manufacturing and/or allied activities,” states PwC India partner (regulatory services) Anshul Jain. “One may note that the Indian Partnership Act also defines a business in the same manner. This makes the stand taken as regards LLP a bit odd,” he adds.

“My view is, if the regulator has registered LLP in the past and allowed partnership firms to do manufacturing activity, then there is no harm in an LLP continuing to do the manufacturing business. There is too much of intrusion by introducing ad hoc notifications. It should be left to the entrepreneurs to decide on the type of entity to do business,” states Bengaluru-based practising company secretary J Sundharesan.

“The restriction on including manufacturing activities for LLP may be due to an apprehension that, for entities with massive manufacturing operations having factories and heavy investments in machinery, the LLP structure may not be suitable. However, if that was the case, this should have been restricted at the very first stage,” states Gopika Shah, partner at GHV & Co, a firm of practising company secretaries.

The Institute of Company Secretaries of India (ICSI) has represented to the MCA that the objective does not seem to restrict manufacturing entities as LLPs, nor are any such restrictions placed in countries like Singapore and the UK. “In case there is an apprehension that manufacturing business incorporated as LLPs would become very large and not suitable as an LLP entity, a threshold limit on share capital or turnover may be considered,” it suggests.

Explaining the possible intent of the notification, Jain states, “There are certain disclosures required under the Companies Act, such as filing of key resolutions of board meetings or special resolutions of shareholders meetings, which doesn’t apply in case of LLPs. Concerns in this regard could have led to this stand taken by the MCA.”

Till date, professionals say that no notices have been received by existing LLPs engaged in manufacturing. “However, there are only two options available to them. They can either close down the LLP and do business in the form of an unincorporated entity like a proprietary or partnership format, or convert the LLP into a company, which may be troublesome for small- and mid-level LLPs,” explains Shah.

No comments:

Post a Comment