Elections are approaching and central government is in mood to

impress GST tax payers. Businessmen are angry with government as it has

charged late filing fee but did not compensate for

technical errors on GST website.

We discussed with many registered GST tax payers and chartered accountants. Here is what a chartered accountant had to say.

However, now government do not want to disappoint consultants and tax payers and have decided to pay for its own faults. Government officials have said that their AI (Artificial Intelligence) powered servers have calculated time lost by each tax payer and accordingly they will pay.

Question was asked whether the money will be recovered from Infosys (company handling tech part of GSTN), government officials said money will be paid from tax collected.

Surprisingly now you can apply for refund, the amount is auto calculated. To apply for refund you need to follow these steps.

Refunds are targeted to be released in 7 working days. Once you have applied for refund, you can assign refund to either your own account or your consultant's account.

technical errors on GST website.

We discussed with many registered GST tax payers and chartered accountants. Here is what a chartered accountant had to say.

We have lost many hours due to technical errors on GST website. We hardly get any money for GST returns but all time goes in trying to get GST website working. We hope government pay us for all time lost on website.This is similar to what many consultants said to us.

However, now government do not want to disappoint consultants and tax payers and have decided to pay for its own faults. Government officials have said that their AI (Artificial Intelligence) powered servers have calculated time lost by each tax payer and accordingly they will pay.

Question was asked whether the money will be recovered from Infosys (company handling tech part of GSTN), government officials said money will be paid from tax collected.

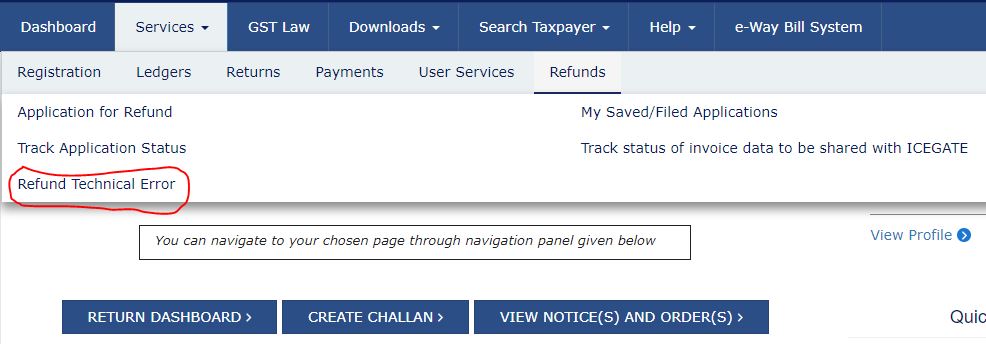

Surprisingly now you can apply for refund, the amount is auto calculated. To apply for refund you need to follow these steps.

- Login to GST website.

- Click on Services

- Click on Refunds

- Click on Refund Technical Error

Refunds are targeted to be released in 7 working days. Once you have applied for refund, you can assign refund to either your own account or your consultant's account.

No comments:

Post a Comment