Search This Site

Wednesday, December 30, 2020

Tuesday, December 29, 2020

Monday, December 28, 2020

Saturday, December 26, 2020

Friday, December 25, 2020

GST: Restriction on utlization of ITC credit (Electronic Credit Ledger) U/r 36(4) & 86B

Wednesday, December 23, 2020

Sunday, December 13, 2020

CA arrested in Mumbai in GST fraud case

Central Goods and Services Tax, Mumbai West, Investigation team has announced the arrest of Mr. Chandraprakash Pandey, Partner of M/s. C.P. Pandey & Associates. He was arrested on account of indulging in

Tuesday, November 10, 2020

Saturday, November 7, 2020

Another CA removed by ICAI for professional misconduct

The Institute of Chartered Accountants of India (ICAI) notified the removal of a Chartered Accountant after finding him guilty of professional misconduct. The CA was

Sunday, November 1, 2020

TaxAudit Checklist u/s 44AB of Income tax Act, 1961 brought out by Direct Taxes Committee & Taxation Audit Quality Review Board of ICAI

Institute of Chartered Accountants of India - ICAI (@theicai) Tweeted:

#TaxAudit Checklist u/s 44AB of Income tax Act, 1961 brought out by Direct Taxes Committee & Taxation Audit Quality Review Board of ICAI

CA guilty of Non Reporting of non-compliance of section 40A(3) & 40(a)(ia) ICAI remove name of CA from Register of Members

Saturday, October 31, 2020

Thursday, October 29, 2020

Saturday, October 24, 2020

Thursday, October 22, 2020

Sunday, October 18, 2020

Free Income tax Return filing for senior citizens for FY 2019-20

We at CANEWSBeta are happy to announce Free Income tax Return filing for senior citizens for FY 2019-20. Following are the terms and conditions:

Saturday, October 17, 2020

Analysis of of Tax Collected at Source TCS under Section 206C (1H) of the Income Tax Act, 1961 on sale of goods wef 1st October 2020

Tax Collected at source (TCS) is Income Tax which is required to be collected by the seller (Collector) from the Buyer along with the Price of Goods and applicable taxes. Provisions relating to tax Collected at Source has been enumerated in section 206C of the Income Tax Act, 1961. There are various goods on which tax has to be collected at source which is given below :-

Friday, October 9, 2020

Thursday, October 8, 2020

Thursday, October 1, 2020

Sunday, September 27, 2020

Thursday, September 24, 2020

Wednesday, September 23, 2020

Live Webinar Series -2 on “ICAI in Conversation with its Students”

BOS (Academic) & SSEB of ICAI presents “ICAI in Conversation with its Students”, a Live Series-2 Interactive Session with students on

Sunday, September 20, 2020

Saturday, September 19, 2020

High lights of the RACP Bill 2020 introduced in Lok Sabha.(Bill no- 116 of 2020)

Direct Taxes

High lights of the RACP Bill 2020 introduced in Lok Sabha.(Bill no- 116 of 2020)

1) ITR filing for AY 2019-20 is to be extended from 30th Sep to 31-3-2021.

2) ITR filing for AY 2020-21 is to be extended from 30th Nov. to 31-3-2021.

3) Filing of audit reports under any provision for AY 2020-21 is to be extended from 31st Oct to

Sunday, August 2, 2020

Friday, July 31, 2020

ICAI announces financial assistance to its members and their dependants suffering from Corona virus

Thursday, July 30, 2020

5 income tax-related deadlines

Sunday, July 26, 2020

Saturday, July 25, 2020

Friday, July 24, 2020

NFRA bars former Deloitte head from audit for 7 years over lapses at IL&FS

MCX India Auditor Selection Norms for Cyber Security & Cyber Resilience Audit of Member

Cyber Security & Cyber Resilience Audit

Cyber Security & Cyber Resilience Audit of Member

Wednesday, July 22, 2020

Vacancy for CA Inter in Meridian Enterprises Pvt. Ltd

Nariman Point, Mumbai

Friday, July 3, 2020

ICAI announces Reduction of fees for MCS & Adv ITT Courses for students undergoing Virtual classes for May 2019, Nov 2019, May 2020 & Nov 2020 Final Students

| Students Skills Enrichment Board, BOS (O) The Institute of Chartered Accountants of India 3rd July, 2020 |

| ANNOUNCEMENT |

|

Reduction of fees for MCS & Adv ITT

Courses for students undergoing Virtual classes for May 2019, Nov 2019,

May 2020 & Nov 2020 Final Students

In view of the ongoing spurt of COVID-19 virus pandemic and subsequent suspension of IT and Soft Skills Classes all across the country, the competent authority has decided that the students of Final course exam (May 2019, November 2019, July, 2020 & November,2020) as one time measure, can undergo MCS and Advanced IT Course through Virtual Mode and has further decided to |

Wednesday, July 1, 2020

High Court directs IT department to refund Rs.833 crores to Vodafone Idea Ltd within 2 weeks

Monday, June 29, 2020

Saturday, June 27, 2020

Saturday, June 20, 2020

AAR tweaks definition of aggregrate turnover to include interest from PPF, Bank savings and loans used for GST registration threshold

The Authority for Advance Ruling (AAR) has said the value of exempted income, like interest on PPF, savings bank account and loans given to family or friends, will now be included along with taxable supplies while calculating the threshold limit for obtaining GST registration.

For businesses and individuals, they are required to obtain GST registration if their aggregate

Goods purchased, sold overseas liable to GST in India: AAR

Gutkha baron Wadhwani siphoned GST money to Pakistan, Dubai, court told evades Rs.233 crores GST

The central agency investigating the case of GST evasion of GST through illegal trading of pan

PWC loses its own case in ITAT: held that dividend-bearing securities should be considered for disallowance under Rule 8D(2)(iii) of the Income Tax Rules.

The appellant PricewaterhouseCoopers Private Limited is in the business of providing, inter alia, management consultancy services, and also accounting and business advisory services. The

Tuesday, June 16, 2020

Supreme Court order provides big relief to auditors of IL&FS ie Deloitte and BSR & Associates

Saturday, June 13, 2020

Friday, June 12, 2020

‘Postpone Examinations Till November’, demand ICAI Students on twitter

While many state education board postponing the exams, CA students demanded that the ICAI July

Parotta and roti are separate: Authority for Advance Rulings' Karnata bench hence different GST rates applicable to both

As per a recent rule by the Authority for Advance Rulings' Karnata bench, parotta and roti are separate. Distinguishing between the two Indian varieties of shortbread, the GST ruling said that

EOW arrests Congress MLC and Chairman of Shivajirao Bhosale Co-op Bank based on FIR filed by Chartered Accountant appointed as RBI Auditor

PUNE: The city police’s economic offences wing recently filed a chargesheet against Nationalist Congress Party’s sitting MLC Anil Bhosale and three other accused, pegging the total embezzlement

RBI asks SBI to appoint a qualified chartered accountant as CFO whose estimated package is Rs.1 crore

A senior SBI executive said due to the central bank's directive, the bank has decided to opt for an

Friday, May 29, 2020

Will ICAI be able to conduct exams in July

Thursday, May 21, 2020

Whatsapp can be used for virtual hearing by GST and Excise Authorities says CBIC

GST applicable on Director's Remuneration

Friday, May 8, 2020

Free Online Revision classes for CA Final, Inter & Foundation

1.) *International Tax Course* starting from *9th May 6PM* 8 weekends, 16 classes, 1.5 hours each, Practical Experience

Course coverage:- Basic to Best

Saturday, May 2, 2020

Friday, May 1, 2020

Tuesday, April 21, 2020

Is India economic super power in making with unprecedented fall in crude oil prices

Sunday, April 12, 2020

Contribution to PM CARES Fund qualifies as CSR expenditure, Contribution to CM’s Relief Fund does not: MCA

Saturday, April 11, 2020

CANeWsBeta*- Monthly Top Commentator Contest win Rs.1000/- p.m

Seasons Greetings to all our viewers!

CANeWsBeta is happy to announce Top Commentator Monthly Contest. Now win Rs.1000 talktime or recharge of utility bills or DTH services by just commenting on the our news articles at :https://canewsbeta.blogspot.com/

Terms & Conditions of the contest:

Friday, April 10, 2020

How to withdraw from EPF if you need money due to coronavirus

The government announced last week that you can withdraw a certain amount from your Employees' Provident Fund (EPF) corpus, if you are facing financial problems due to the coronavirus-related

Vacancy for CA in P&G

Description

About Procter & Gamble:

Procter & Gamble is one of the largest FMCG (Fast Moving Consumer Goods) company in the world with strong brands like Pampers, Ariel, Always, Gillette and Oral B just to name a few. For more

Notice Inviting Expression of Interest for engagement of Chartered Accountants Firms for Statutory Audit of various units of the Institute of Chartered Accountants of India (ICAI) for the financial year 2020-21.

-

Apr, 15 2020

-

The Institute of Chartered Accountants of India, Multi Location, Multi State

Notice Inviting Expression of Interest for engagement of Chartered Accountants Firms for Statutory Audit of various units of the Institute of Chartered Accountants of India (ICAI) for the financial year 2020-21.

Address :

Notice Inviting Expression of Interest for engagement of Chartered Accountant Firms for Internal Audit of various units of the Institute of Chartered Accountants of India (ICAI) for the financial year 2020-21.

-

Apr, 15 2020

-

The Institute of Chartered Accountants of India, Multi Location, Multi State

Notice Inviting Expression of Interest for engagement of Chartered Accountant Firms for Internal Audit of various units of the Institute of Chartered Accountants of India (ICAI) for the financial year 2020-21.

Address :

Tender for chartered accountant services for Nathdawara Temple Board

-

Apr, 15 2020

-

Nathdawara Temple Board, Nathdwara Rajasthan

Tender for chartered accountant on retainer ship.

Address :

Tuesday, April 7, 2020

ICAI: Standard 12 Students Can Provisionally Register For CA Course

| Announcement |

| 5th April 2020 |

|

Sub: Allowing provisional registration in the

Foundation Course of Institute of Chartered Accountants of India (ICAI)

for students who have been allotted either admit card and/or appeared

in one or more papers of Class XII examinations

Due to the outbreak of the COVID -19 pandemic, the CBSE/ICSE/State Boards have postponed Class 12th Board examinations that were to be held from 19th March 2020 and onwards. In view of above, such candidates who are not able to register themselves in the Foundation due to non-appearance in all papers of class 12th Examination, the Competent Authority has decided to relax the eligibility criteria for registering in Foundation Course, as a one-time measure, which is as |

Monday, April 6, 2020

Request for Proposal (RfP) for Appointment of Chartered Accountant firm / LLP / company for Handling Direct Tax matters of DICGC for FY 2020-2021

-

Apr, 07 2020Request for Proposal (RfP) for Appointment of Chartered Accountant firm / LLP / company for Handling Direct Tax matters of DICGC for FY 2020-2021

Address :

Statewise official Active Covid-19/Coronavirus cases in India as on 6/4/2020 9 a.m alongwith detailed analysis of statewise increase/decrease

| S. No. | Name of State / UT | Total Confirmed cases (Including 66 foreign Nationals) | Cured/Discharged/ Migrated |

Death |

|---|---|---|---|---|

| 1 | Andhra Pradesh | 226 | 1 | 3 |

| 2 | Andaman and Nicobar Islands | 10 | 0 | 0 |

| 3 | Arunachal Pradesh | 1 | 0 | 0 |

| 4 | Assam | 26 | 0 | 0 |

| 5 | Bihar | 30 | 0 | 1 |

| 6 | Chandigarh | 18 | 0 | 0 |

| 7 | Chhattisgarh | 9 | 3 | 0 |

| 8 | Delhi | 503 | 18 | 7 |

| 9 | Goa | 7 | 0 | 0 |

| 10 | Gujarat | 122 | 18 | 11 |

| 11 | Haryana | 84 | 25 | 1 |

| 12 | Himachal Pradesh | 13 | 1 | 1 |

| 13 | Jammu and Kashmir | 106 | 4 | 2 |

| 14 | Jharkhand | 3 | 0 | 0 |

| 15 | Karnataka | 151 | 12 | 4 |

| 16 | Kerala | 314 | 55 | 2 |

| 17 | Ladakh | 14 | 10 | 0 |

| 18 | Madhya Pradesh | 165 | 0 | 9 |

| 19 | Maharashtra | 690 | 42 | 45 |

| 20 | Manipur | 2 | 0 | 0 |

| 21 | Mizoram | 1 | 0 | 0 |

| 22 | Odisha | 21 | 2 | 0 |

| 23 | Puducherry | 5 | 1 | 0 |

| 24 | Punjab | 68 | 4 | 6 |

| 25 | Rajasthan | 253 | 21 | 0 |

| 26 | Tamil Nadu | 571 | 8 | 5 |

| 27 | Telengana | 321 | 34 | 7 |

| 28 | Uttarakhand | 26 | 4 | 0 |

| 29 | Uttar Pradesh | 227 | 19 | 2 |

| 30 | West Bengal | 80 | 10 | 3 |

| Total number of confirmed cases in India | 4067* | 292 | 109 | |

| *States wise distribution is subject to further verification and reconciliation | ||||

Total rise of 472 cases in India compared to 5/4/2020. Also see status as on 5/4/2020 click here

Total average percentage increase across India of 20.54% in a day.

There is reduction in percentage increase of cases in following states compared to 5/4/2020 ie in 24 hrs:

Sunday, April 5, 2020

Saturday, April 4, 2020

Statewise official Active Covid-19/Coronavirus cases in India as on 5/4/2020 9 a.m alongwith detailed analysis of statewise increase/decrease

| S. No. | Name of State / UT | Total Confirmed cases (Including 65 foreign Nationals) | Cured/Discharged/ Migrated |

Death |

|---|---|---|---|---|

| 1 | Andhra Pradesh | 161 | 1 | 1 |

| 2 | Andaman and Nicobar Islands | 10 | 0 | 0 |

| 3 | Arunachal Pradesh | 1 | 0 | 0 |

| 4 | Assam | 24 | 0 | 0 |

| 5 | Bihar | 30 | 0 | 1 |

| 6 | Chandigarh | 18 | 0 | 0 |

| 7 | Chhattisgarh | 9 | 3 | 0 |

| 8 | Delhi | 445 | 15 | 6 |

| 9 | Goa | 7 | 0 | 0 |

| 10 | Gujarat | 105 | 14 | 10 |

| 11 | Haryana | 49 | 24 | 0 |

| 12 | Himachal Pradesh | 6 | 1 | 1 |

| 13 | Jammu and Kashmir | 92 | 4 | 2 |

| 14 | Jharkhand | 2 | 0 | 0 |

| 15 | Karnataka | 144 | 12 | 4 |

| 16 | Kerala | 306 | 49 | 2 |

| 17 | Ladakh | 14 | 10 | 0 |

| 18 | Madhya Pradesh | 104 | 0 | 6 |

| 19 | Maharashtra | 490 | 42 | 24 |

| 20 | Manipur | 2 | 0 | 0 |

| 21 | Mizoram | 1 | 0 | 0 |

| 22 | Odisha | 20 | 0 | 0 |

| 23 | Puducherry | 5 | 1 | 0 |

| 24 | Punjab | 57 | 1 | 5 |

| 25 | Rajasthan | 200 | 21 | 0 |

| 26 | Tamil Nadu | 485 | 6 | 3 |

| 27 | Telengana | 269 | 32 | 7 |

| 28 | Uttarakhand | 22 | 2 | 0 |

| 28 | Uttar Pradesh | 227 | 19 | 2 |

| 29 | West Bengal | 69 | 10 | 3 |

| Total number of confirmed cases in India | 3374* | 267 | 77 | |

| *States wise distribution is subject to further verification and reconciliation | ||||

Total rise of 472 cases in India compared to 4/4/2020. Also see status as on 4/4/2020 click here

Total average percentage increase across India of 16.26% in a day.

There is reduction in percentage increase of cases in following states compared to 4/4/2020 ie in 24 hrs:

ICAI should come out with Guidance note on Audit procedures during epidemic to prevent health risk of articles and members

Statewise official Active Covid-19/Coronavirus cases in India as on 4/4/2020 9 a.m

COVID-19 Statewise Status Also see status as on 22/3/2020 click here

| S. No. | Name of State / UT | Total Confirmed cases (Including 57 foreign Nationals) | Cured/Discharged/ Migrated |

Death |

|---|---|---|---|---|

| 1 | Andhra Pradesh | 161 | 1 | 1 |

| 2 | Andaman and Nicobar Islands | 10 | 0 | 0 |

| 3 | Arunachal Pradesh | 1 | 0 | 0 |

| 4 | Assam | 24 | 0 | 0 |

| 5 | Bihar | 29 | 0 | 1 |

| 6 | Chandigarh | 18 | 0 | 0 |

| 7 | Chhattisgarh | 9 | 3 | 0 |

| 8 | Delhi | 386 | 8 | 6 |

| 9 | Goa | 6 | 0 | 0 |

| 10 | Gujarat | 95 | 10 | 9 |

| 11 | Haryana | 49 | 24 | 0 |

| 12 | Himachal Pradesh | 6 | 1 | 1 |

| 13 | Jammu and Kashmir | 75 | 3 | 2 |

| 14 | Jharkhand | 2 | 0 | 0 |

| 15 | Karnataka | 128 | 12 | 3 |

| 16 | Kerala | 295 | 41 | 2 |

| 17 | Ladakh | 14 | 3 | 0 |

| 18 | Madhya Pradesh | 104 | 0 | 6 |

| 19 | Maharashtra | 423 | 42 | 19 |

| 20 | Manipur | 2 | 0 | 0 |

| 21 | Mizoram | 1 | 0 | 0 |

| 22 | Odisha | 5 | 0 | 0 |

| 23 | Puducherry | 5 | 1 | 0 |

| 24 | Punjab | 53 | 1 | 5 |

| 25 | Rajasthan | 179 | 3 | 0 |

| 26 | Tamil Nadu | 411 | 6 | 1 |

| 27 | Telengana | 158 | 1 | 7 |

| 28 | Uttarakhand | 16 | 2 | 0 |

| 28 | Uttar Pradesh | 174 | 19 | 2 |

| 29 | West Bengal | 63 | 3 | 3 |

| Total number of confirmed cases in India | 2902 | 184 | 68 | |

ICAI CA Final May 2019 Question Papers with Suggested Answers (Old Course)

| Subject | Question Paper | Suggested Answers |

|---|---|---|

| Paper 1: Financial Reporting | Download | Download |

| Paper 2: Strategic Financial Management | Download | Download |

| Paper 3: Advanced Auditing and Professional Ethics | Download | Download |

| Paper 4: Corporate and Allied Laws | Download | Download |

| Paper 5: Advanced Management Accounting | Download | Download |

| Paper 6: Information Systems Control and Audit | Download | Download |

| Paper 7: Direct Tax Laws | Download | Download |

| Paper 8: Indirect Tax Laws | Download | Download |

Friday, April 3, 2020

Thursday, April 2, 2020

Wednesday, April 1, 2020

Monday, March 30, 2020

Why there cannot be recession in India

In India a child is brought up by teaching him all religious rituals and making him visit religious places regularly and during his school vacations. And thing he is taught religiously is to donate at such religious places either money or in kind. Now you must be wondering how it is connected to recession. Here's how believe it or not on average every earning member in India has sub conscious habit built into him to donate a certain percent of his monthly or new income to religious places as

Saturday, March 28, 2020

Friday, March 27, 2020

Thursday, March 26, 2020

Finance Minister covid 19 fiscal package highlights

- Rs.1.72 lac crore fiscal package

- Insurance coverage for all nurses doctors sanitisation workers Rs.50 lac per person

- Under Pm gareeb kalyan scheme 80 crore poor people to get additional 5kgs wheat or rice 1kg pulse for 3 months free of cost.

- Direct transfers to Farmer mnrega jan dhan yojna pensioners Ujwala yojna epfo construction workers

Monday, March 23, 2020

Sunday, March 22, 2020

ICAI: CA May exams on schedule, will analyse the situation in mid-April

Statewise official Active COVID-19/Coronavirus cases in India as 22.03.2020

(*including foreign nationals, as on 22.03.2020 at 11:45 AM)

Saturday, March 21, 2020

Surprisingly ICAI/ICSI/ICMA have still not declared postponement of article ship in wake of coronavirus scare

Avoid air conditioners Maharashtra Government gives new directives

ICAI announces Exemption from Completion of MCS Course & Adv.ITT to appear in Final May 2020 Examination

| Announcement |

|

Exemption from Completion of Management and

Communication Skills Course (MCS Course) & Advanced Information

Technology Training (Adv.ITT) to appear in Final May 2020 Examination

The Council at its meeting held on 20th March,2020 invoked the powers under Regulation 205 of |

Statewise official Active COVID-19/Coronavirus cases in India as 21.03.2020

- Total number of passengers screened at airport : 14,59,993

Total number of Active COVID 2019 cases across India * :

Friday, March 20, 2020

Thursday, March 19, 2020

June CFA Program Exams POSTPONED

June CFA Program Exams POSTPONED

For the safety of our global community, CFA Institute has made the decision to postpone the June 2020 CFA Exam administration.

Knowing that candidates have spent hours studying and preparing for the June exam, we want to giv

Sebi postponed Q4, FY20 earnings Due date

Among other things, the markets regulator allowed companies to submit their

Wednesday, March 18, 2020

CPA Canada has cancelled all CPA PEP and Common Final Examination will ICAI and ICSI also follow?

Invitation To Online Tender And Instructions To Tenderers For Appointment Of Firms Of Chartered Accountants

Address :

ICAI postpones Advanced ICITSS- Information Technology Test

| ANNOUNCEMENT |

| 13th March, 2020 |

|

Postponement of Advanced ICITSS- Information Technology Test scheduled to be held on 15th March, 2020.

The Council at its Special Meeting held on 12th March, 2020 has reviewed the Advisory to Regional Councils and Branches, issued on 11th March 2020 regarding avoiding large gathering as |

Tuesday, March 17, 2020

Get ready for biggest bull run history has witnessed till date.

Supreme Court says: All AGR dues to be paid, no self-assessment or objections to be entertained

Vodafone share prices fall by 40% from days high

Hearing the Department of Telecommunications (DoT) plea in regard to the adjusted gross revenue (AGR) case, a bench of the Supreme Court of India on March 18 held that no further objections to its orders would be allowed against payable dues.

In its order, the three-judge bench led by Justice Mishra, and comprising Justices S Abdul Nazeer and MR Shah held that no self-assessment can be done and no further objection would be entertained.

The SC order stated: "No self-assessment can be done and no further objection would be entertained. Actions of telcos are tantamount to seeking to bypass our judgement. All dues as per our judgement

Cent Bank Home Finance Ltd Invites Applications For Empanelment As Concurrent Auditors

-

Mar, 18 2020

-

Cent Bank Home Finance Ltd, Bhopal, Madhya Pradesh

Invites Applications For Empanelment As Concurrent Auditors

Address :

Monday, March 16, 2020

Will ICAI and ICSI be able to conduct its examinations as scheduled in May and June 2020?

As per latest news many states likes Maharashtra, Delhi, Tamil Nadu have announced closure of all schools, colleges, educational institutions, classes, etc. Maharashtra Govt as per reports has

Saturday, March 14, 2020

GSTR 9 and 9C due date for FY 2018-19 postponed by GST council

Maharashtra Govt orders closure of all accounts in Pvt banks by Mar 31

Thursday, March 12, 2020

Tuesday, March 10, 2020

Monday, March 9, 2020

Three Infosys employees held for taking bribes from taxpayers

According to police, the key accused among the three was attached to the CPC's data division and

Sunday, March 8, 2020

Thursday, March 5, 2020

Wednesday, March 4, 2020

Tuesday, March 3, 2020

Companies Amendment Rules, 2020- Appointment and Qualification of Directors

The Central Government therefore prepare the following standards further to alter the Companies (Appointment and Qualification of Directors) Rules, 2014, i.e. .:-

Monday, March 2, 2020

Friday, February 28, 2020

Major key clause wise changes/ Comparison in/of CARO 2020 v CARO 2016

Key Changes/Highlights between CARO 2016 and new CARO 2020

| CARO 2016 | CARO 2020 | Nature of Change | ||

| Clause No | Matter | Clause No. | Matter | |

| i (a) | Whether the company is maintaining proper records showing full particulars, including quantitative details and situation of fixed assets | i(a)(A) | Whether the company is maintaining proper records showing full particulars, including quantitative details and situation of Property, Plant and Equipment; | No Change |

Tally releases new version of software with browser access, to enable GST e-invoicing

Highlights

- This will help entrepreneurs with business information like business reports and invoices.

- The customers remain in custody of their business data, while getting access to it using a simple web browser.

- Tally has about 17 lakh paying customers in India and the company says GST has given it a

Thursday, February 27, 2020

Monday, February 17, 2020

Massive fire breaks out at GST Bhavan

The fire broke out on the 8th floor of the GST Bhavan. At 12:42 pm Mumbai Fire Brigade

Sunday, February 16, 2020

All Indians travelling abroad will have to pay upto 10% Income tax wef 1/4/2020

Indore: Union finance minister Nirmala Sitharaman has raised alarm bells for those who travel abroad on tour package booked by others, which is a common trend to oblige senior officials in government and private sector in the country.

From April 1, 2020, every foreign traveller will have to pay 5% (PAN holder) and 10% (non-PAN holder) TCS (Tax Collection at Source) on total amount of tour package. By paying TCS, every

Money Saving tip of the day - 16/02/2020

Calcutta HC Directs RBI To Consider Steps Including Cancellation Of License Of Bank Of Baroda

In a major blow to the Bank of Baroda, the Calcutta High Court has asked the RBI to consider taking appropriate steps against the bank, including revocation of its license, for its disorderly conduct in dealing with payment against an

Friday, February 14, 2020

Officials move to recover ₹46,000 cr interest on delayed GST payment

Wednesday, February 12, 2020

IRCTC post huge rise in PAT

Total Income rises by 28% YOY and 37% QOQ

I-T cracks down on Indians owning Dubai properties

The Intelligence and Criminal Investigation Wing of the I-T Dept prepared a list of 2,000 Indian

Sunday, February 9, 2020

RBI has stopped printing Rs.2000 notes since October 2019

The circulation of Rs 2,000 denomination currency notes has reportedly been put under restrictions by a top public sector bank.

Department is using Artificial Intelligence to send you GST notices and advisories

Friday, February 7, 2020

Wednesday, February 5, 2020

Daily Retail Food Price in India (06/02/2020) and its increase/decrease in percentage

| Food Name | UOM | Brand | 06-02-2020 |

| Rate/UOM (Rs.) | |||

| Sugar | 1Kg | Madhur sugar | 45.00 |

| Salt | 1Kg | Tata table Salt | 18.00 |

News Archive

-

►

2022

(3)

- ► September 2022 (1)

- ► August 2022 (1)

- ► April 2022 (1)

-

►

2021

(12)

- ► October 2021 (1)

- ► April 2021 (1)

- ► March 2021 (1)

-

▼

2020

(252)

-

▼

December 2020

(8)

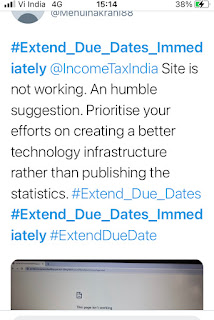

- Extended due dates of Income returns, ITR and GSTR...

- TAX AUDIT AND ITR DUE DATE EXTENDED ON PORTAL|GST ...

- Writ Petition filed in Bombay High court wrt exten...

- Income tax site crashes 5 days before due date of ...

- GST: Restriction on utlization of ITC credit (Elec...

- CA dies at 40 due to high work pressure

- GST and Income Tax due date extention almost certain

- CA arrested in Mumbai in GST fraud case

- ► November 2020 (5)

-

►

October 2020

(12)

- BIG RELIEF IN GSTR-1 FILING NOVEMBER 20 |OPTION TO...

- CBIC has released a guidebook for Faceless Assessment

- Increase in fake CA certification

- GST Audit date further extended

- Finance Ministry: Extension of due date of furnish...

- Income Tax Department has released New Tax Audit ...

- Free Income tax Return filing for senior citizens ...

- Analysis of of Tax Collected at Source TCS under S...

- GSTR9/9C Big Update|Gstr9 Big Relief By Cbic|New C...

- ICAI announces postponement of Foundation exams an...

- TCS new provision wef 1st October 2020 in simple c...

- Subramanyam Swami on possibility of postponing CA ...

- ► September 2020 (5)

-

►

July 2020

(12)

- ICAI announces financial assistance to its members...

- ICAI clarifies on the news article by Times of Ind...

- 5 income tax-related deadlines

- ICAI launches MSME Business continuity checklist

- ICAI Vice President Latest Update on Nov 2020 CA E...

- NFRA bars former Deloitte head from audit for 7 ye...

- MCX India Auditor Selection Norms for Cyber Securi...

- Vacancy for CA Inter in Meridian Enterprises Pvt. Ltd

- ICAI announces Reduction of fees for MCS & Adv ITT...

- SC adjourns hearing on CA exams to next week

- High Court directs IT department to refund Rs.833 ...

- ICAI issues guidance note on CARO 2020

-

►

June 2020

(16)

- ICAI BOS IMPORTANT ANNOUNCEMENT FOR NOV. 2020 CA E...

- BIG CHANGE IN CASH WITHDRAWAL FROM 01.07.2020 TDS ...

- AAR tweaks definition of aggregrate turnover to in...

- Goods purchased, sold overseas liable to GST in In...

- Gutkha baron Wadhwani siphoned GST money to Pakist...

- PWC loses its own case in ITAT: held that dividend...

- Supreme Court order provides big relief to auditor...

- Dhiraj Khandelwal tweets on extention of old cours...

- ICSI postpones CS examinations which were schedule...

- National Student's Union of India writes to ICAI a...

- ‘Postpone Examinations Till November’, demand ICAI...

- GST LATE FEES WAIVED OFF FROM JULY 17 TO JAN 20|Gs...

- Parotta and roti are separate: Authority for Advan...

- TWO OPTIONS TO BE GIVEN FOR GST LATE FEES|GSTR3B F...

- EOW arrests Congress MLC and Chairman of Shivajira...

- RBI asks SBI to appoint a qualified chartered acco...

-

►

May 2020

(7)

- Will ICAI be able to conduct exams in July

- Whatsapp can be used for virtual hearing by GST an...

- GST applicable on Director's Remuneration

- Free Online Revision classes for CA Final, Inter &...

- ICAI postpones all CA exams to July 2020

- Revised MHA order dated 1/5/2020 w.r.t guidelines ...

- ICSI postpones all CS examinations to be held in J...

-

►

April 2020

(29)

- Is India economic super power in making with unpre...

- Contribution to PM CARES Fund qualifies as CSR exp...

- CANeWsBeta*- Monthly Top Commentator Contest win R...

- ICAI ICSI AND ICMA contribute to PM CARES fund

- DO NOT DO THESE MISTAKES IN GSTR3B FOR FEB TO APRI...

- How to withdraw from EPF if you need money due to ...

- Vacancy for CA in P&G

- Notice Inviting Expression of Interest for engagem...

- Notice Inviting Expression of Interest for engagem...

- Tender for chartered accountant services for Nathd...

- GST NEW DUE DATES SUMMARY FROM FEBRUARY , MARCH , ...

- ICAI: Standard 12 Students Can Provisionally Regis...

- Request for Proposal (RfP) for Appointment of Char...

- Statewise official Active Covid-19/Coronavirus cas...

- Analysis of Certified Copy of CA Final ISCA - 94 M...

- Review of certifed copy of 91 Marks in CA IPCC Cos...

- IPCC Accounting Certified Copy Review

- GOOD NEWS|MOST AWAITED RELIEF IN GST RULE 36(4) GI...

- Latest Fixed Deposit rates and other fixed income ...

- CBDT issues orders u/s 119of IT Act,1961 to mitiga...

- Statewise official Active Covid-19/Coronavirus cas...

- ICAI should come out with Guidance note on Audit p...

- Statewise official Active Covid-19/Coronavirus cas...

- ICAI CA Final May 2019 Question Papers with Sugges...

- ICAI CA Final May 2019 Question Papers with Sugges...

- BREAKING NEWS|GSTR3B MUST BE FILED BEFORE 04.04.20...

- Now Watch Bombay Municipal Corporation declared Co...

- NEW SECTION 168A INTRODUCED IN GST ACT

- RBI notifies Doorstep Banking Services for Senior ...

-

►

March 2020

(52)

- Why there cannot be recession in India

- What is Fibonacci Retracement? How to use Fibonacc...

- ICAI issues guidelines for impact of coronavirus o...

- ICAI POSTPONES MAY 2020 EXAMS

- ICAI important announcement on articleship period ...

- Dhiraj Khandelwal hints at shifting May attempt al...

- Finance Minister covid 19 fiscal package highlights

- Prime Minister to address nation today

- ICAI sends representation to delete GST ITC Rule 3...

- ICAI: CA May exams on schedule, will analyse the s...

- Statewise official Active COVID-19/Coronavirus cas...

- Surprisingly ICAI/ICSI/ICMA have still not declare...

- Avoid air conditioners Maharashtra Government give...

- ICAI announces Exemption from Completion of MCS Co...

- Statewise official Active COVID-19/Coronavirus cas...

- CM Uddhav Balasaheb Thackeray announces closure of...

- ICAI RE -OPENS ON-LINE FACILITY FOR SEEKING CHANGE...

- June CFA Program Exams POSTPONED

- Sebi postponed Q4, FY20 earnings Due date

- Bank Audit - Interest subvention for Short Term Cr...

- WHETHER GSTR1 FILING IS EXEMPTED FOR GST TAXPAYERS...

- CPA Canada has cancelled all CPA PEP and Common Fi...

- Invitation To Online Tender And Instructions To Te...

- ICAI postpones Advanced ICITSS- Information Techno...

- Get ready for biggest bull run history has witness...

- Supreme Court says: All AGR dues to be paid, no se...

- Names of Audit Firms approved for appointment as S...

- Maharashtra Govt may consider closing local train ...

- Cent Bank Home Finance Ltd Invites Applications Fo...

- Will ICAI and ICSI be able to conduct its examina...

- GSTR 9 and 9C due date for FY 2018-19 postponed by...

- Maharashtra Govt orders closure of all accounts in...

- GOOD NEWS! SAN DIEGO LAB INVENTS CORONA VIRUS VACCINE

- Corona Virus Disruption: Imp Directives From The I...

- A book published in 1981 contains story of Coronav...

- Application Form For Empanelment of Concurrent Aud...

- GST RCM UPDATED LIST AS ON 01.03.2020|GST RCM PAYM...

- GSTR1 AMENDMENT FOR FY 2018-19|B2C TO B2B AMENDMEN...

- Three Infosys employees held for taking bribes fro...

- Vacancy for CA/CS in LIC

- ICAI publishes Guidance Note on Audit of Banks 202...

- GST PENALTY OF RS 50000 FOR LATE FILING OF GSTR3B

- Breaking the corona virus myths

- ACCOUNTANTS BE AWARE WHILE DOING ENTRY IN BOOKS|BI...

- MUST DO GST WORK BEFORE 31.03.2020|GSTR9 FILING FO...

- Mumbai Rail Metro Corporation invites tendors for ...

- Cotton Corporation of India invites tenders from c...

- EMPANELMENT OF FIRMS (PARTNERSHIP /LIMITED LIABILI...

- Baba Ramdev explains how yoga and ayurveda provide...

- Companies Amendment Rules, 2020- Appointment and Q...

- Govt GST Lottery Scheme explained win upto Rs.1cro...

- Two new cases of Coronavirus victims confirmed in ...

-

►

February 2020

(26)

- Major key clause wise changes/ Comparison in/of ...

- Tally releases new version of software with browse...

- ADDITIONAL DETAILS IN NEW GST RETURN WEF 1/4/2020

- BREAKING NEWS|GST INTEREST TO BE AUTO CALCULATED I...

- Massive fire breaks out at GST Bhavan

- All Indians travelling abroad will have to pay upt...

- Money Saving tip of the day - 16/02/2020

- Calcutta HC Directs RBI To Consider Steps Includin...

- Officials move to recover ₹46,000 cr interest on d...

- GOOD NEWS|GST LATE FEE WILL BE REFUNDED|SUPREME CO...

- IRCTC post huge rise in PAT

- IRCTC declares stellar interim dividend post IPO y...

- I-T cracks down on Indians owning Dubai properties

- RBI has stopped printing Rs.2000 notes since Octob...

- Department is using Artificial Intelligence to sen...

- ICAI revises rates for services by chartered Accou...

- Daily Retail Food Price in India (06/02/2020) and ...

- ► January 2020 (79)

-

▼

December 2020

(8)

-

►

2019

(694)

- ► December 2019 (42)

- ► November 2019 (59)

- ► October 2019 (116)

- ► September 2019 (32)

- ► August 2019 (32)

- ► April 2019 (77)

- ► March 2019 (105)

- ► February 2019 (73)

- ► January 2019 (71)

-

►

2018

(361)

- ► December 2018 (103)

- ► November 2018 (96)

- ► October 2018 (149)

- ► August 2018 (11)

- ► February 2018 (2)

-

►

2017

(11)

- ► April 2017 (7)

- ► January 2017 (4)

-

►

2016

(605)

- ► August 2016 (6)

- ► April 2016 (132)

- ► March 2016 (72)

- ► February 2016 (154)

- ► January 2016 (42)

-

►

2015

(1356)

- ► December 2015 (76)

- ► November 2015 (94)

- ► October 2015 (86)

- ► September 2015 (142)

- ► August 2015 (42)

- ► April 2015 (92)

- ► March 2015 (233)

- ► February 2015 (94)

- ► January 2015 (42)

-

►

2014

(1256)

- ► December 2014 (54)

- ► November 2014 (52)

- ► October 2014 (83)

- ► September 2014 (102)

- ► August 2014 (120)

- ► April 2014 (128)

- ► March 2014 (259)

- ► February 2014 (201)

- ► January 2014 (119)

-

►

2013

(2600)

- ► December 2013 (195)

- ► November 2013 (59)

- ► October 2013 (172)

- ► September 2013 (407)

- ► August 2013 (219)

- ► April 2013 (217)

- ► March 2013 (473)

- ► February 2013 (241)

- ► January 2013 (219)

-

►

2012

(2695)

- ► December 2012 (213)

- ► November 2012 (168)

- ► October 2012 (253)

- ► September 2012 (173)

- ► August 2012 (278)

- ► April 2012 (256)

- ► March 2012 (310)

- ► February 2012 (289)

- ► January 2012 (184)

-

►

2011

(1842)

- ► December 2011 (228)

- ► November 2011 (316)

- ► October 2011 (188)

- ► September 2011 (167)

- ► August 2011 (138)

- ► April 2011 (194)

- ► March 2011 (151)

- ► February 2011 (22)

- ► January 2011 (17)

-

►

2010

(14)

- ► December 2010 (14)