The GST Authority for Advance Rulings (GST-AAR), Maharashtra,

has held that penal interest paid by a customer for delay in payments

of equated monthly instalments to a finance company is subject to GST.

Experts hold that this ruling, which has recently been made publicly available, will pinch the pockets

of customers and may also lead to litigation. While advance rulings are binding only on the applicant and the tax authorities, they do create precedence in other similar cases.

"This ruling would in most probability be challenged before higher forums. In the meantime, there could be litigation and an exposure towards payment of 18% GST, if the ruling is ultimately upheld by the higher forums as well," says Sunil Gabhawalla, chartered accountant and indirect tax expert.

Bajaj Finance, which applied for this advance ruling, provided various types of loans to its customers. These ranged from car loans, housing loans, personal loans and even loans for purchase of consumer durable goods.

The outstanding dues were payable by the customer through equated monthly instalments (EMIs), either by cheque or electronic mode. EMIs were a fixed amount, covering repayment of both the loan taken and interest due on it. These were payable by the customer on specific dates.

In case of delay in payment of EMIs, Bajaj Finance collected a penal interest, as an additional interest, depending on the number of days of delay. The percentage of penal interest, varied from customer to customer and the nature of the loan – typically it was calculated at 2% to 4% per month on the overdue amount.

As interest on the loan amount itself is not subject to GST, the finance company, in its application contended that the penal interest should also not be covered by a GST levy.

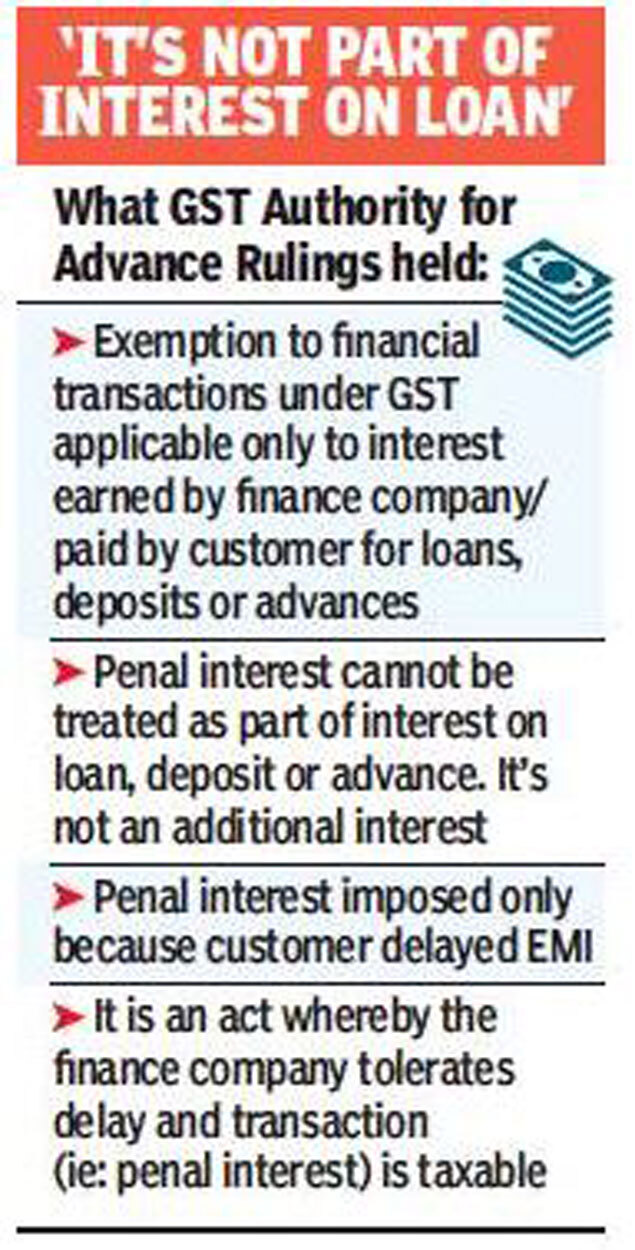

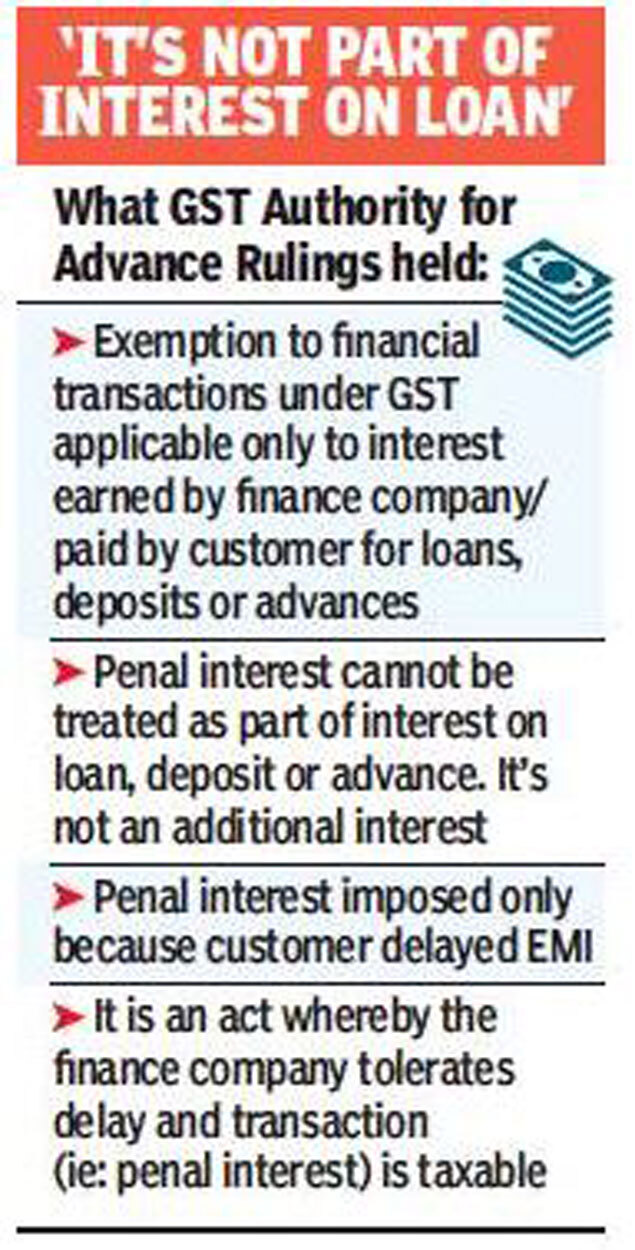

However, the AAR held that GST exemption is available only in respect of interest earned or paid for loans, deposits or advances. If the transaction deviates from this nomenclature, the GST exemption is not available.

“Penal interest on delayed payment of EMIs is a receipt of an amount for tolerating the act of delay on part of the customers. It is not in the nature of additional interest, but is in the nature of a supply which is subject to GST” the AAR ruled.

Gabhawalla adds: “AAR’s ruling seems to be disconnected from the factual matrix. The finance company does not in any way tolerate the delay in payment of EMI by the customer. In fact, the charging of penal interest itself suggests that the finance company is not keen to tolerate the delay. In the current scenario of non-performing assets (NPAs) and accountability, it appears too simplistic a proposition to classify such cases as toleration of a delay by the customers.”

According to a PwC-India alert, “The AAR ruling has adopted a position that appears contrary to the approach adopted historically by the financial services industry.It may create another area of potential dispute and the financial services industry may need to represent this issue to the Central Board of Indirect Taxes and Customs.”

Experts hold that this ruling, which has recently been made publicly available, will pinch the pockets

of customers and may also lead to litigation. While advance rulings are binding only on the applicant and the tax authorities, they do create precedence in other similar cases.

"This ruling would in most probability be challenged before higher forums. In the meantime, there could be litigation and an exposure towards payment of 18% GST, if the ruling is ultimately upheld by the higher forums as well," says Sunil Gabhawalla, chartered accountant and indirect tax expert.

Bajaj Finance, which applied for this advance ruling, provided various types of loans to its customers. These ranged from car loans, housing loans, personal loans and even loans for purchase of consumer durable goods.

The outstanding dues were payable by the customer through equated monthly instalments (EMIs), either by cheque or electronic mode. EMIs were a fixed amount, covering repayment of both the loan taken and interest due on it. These were payable by the customer on specific dates.

In case of delay in payment of EMIs, Bajaj Finance collected a penal interest, as an additional interest, depending on the number of days of delay. The percentage of penal interest, varied from customer to customer and the nature of the loan – typically it was calculated at 2% to 4% per month on the overdue amount.

As interest on the loan amount itself is not subject to GST, the finance company, in its application contended that the penal interest should also not be covered by a GST levy.

However, the AAR held that GST exemption is available only in respect of interest earned or paid for loans, deposits or advances. If the transaction deviates from this nomenclature, the GST exemption is not available.

“Penal interest on delayed payment of EMIs is a receipt of an amount for tolerating the act of delay on part of the customers. It is not in the nature of additional interest, but is in the nature of a supply which is subject to GST” the AAR ruled.

Gabhawalla adds: “AAR’s ruling seems to be disconnected from the factual matrix. The finance company does not in any way tolerate the delay in payment of EMI by the customer. In fact, the charging of penal interest itself suggests that the finance company is not keen to tolerate the delay. In the current scenario of non-performing assets (NPAs) and accountability, it appears too simplistic a proposition to classify such cases as toleration of a delay by the customers.”

According to a PwC-India alert, “The AAR ruling has adopted a position that appears contrary to the approach adopted historically by the financial services industry.It may create another area of potential dispute and the financial services industry may need to represent this issue to the Central Board of Indirect Taxes and Customs.”

No comments:

Post a Comment